Page 121 - CFPA-SCR-Award in General Insurance W01_2018-19_Neat

P. 121

Chapter 8 Contribution and subrogation 8/5

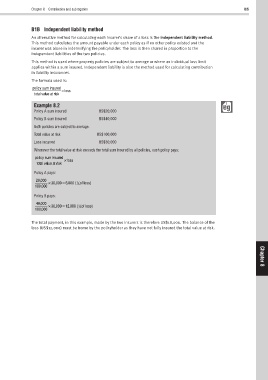

B1B Independent liability method

An alternative method for calculating each insurer’s share of a loss is the independent liability method.

This method calculates the amount payable under each policy as if no other policy existed and the

insurer was alone in indemnifying the policyholder. The loss is then shared in proportion to the

independent liabilities of the two policies.

This method is used where property policies are subject to average or where an individual loss limit

applies within a sum insured. Independent liability is also the method used for calculating contribution

in liability insurances.

The formula used is:

policy sum insured

× loss

total value at risk

Example 8.2

Policy A sum insured US$20,000

Policy B sum insured US$40,000

Both policies are subject to average.

Total value at risk US$100,000

Loss incurred US$30,000

Whenever the total value at risk exceeds the total sum insured by all policies, each policy pays:

policy sum insured

× loss

total value at risk

Policy A pays:

20,000

=

× 30,000 6,000 ( of loss)

1

5

100,000

Policy B pays:

40,000

=

× 30,000 12,000 ( of loss)

2

5

100,000

The total payment, in this example, made by the two insurers is therefore US$18,000. The balance of the

loss (US$12,000) must be borne by the policyholder as they have not fully insured the total value at risk. Chapter

8