Page 336 - MANUAL OF SOP

P. 336

Determination of Net Export Price

(iv) While making adjustments for the costs incurred for the sale of the goods,

the Authority may deduct only those expenses / costs which are normally

incurred by the importers;

(v) The profit, if any, on the sale by the related importer;

(vi) Where there is insufficient information to enable an export price to be

determined; the Authority may resort to the principles of best information

available.

EXPORT PRICE FOR RESIDUARY CATEGORY OR NON-COOPERATING

EXPORTERS:

12.31. The Anti-Dumping Rules do not mandate any particular methodology

for the net export price calculations for the residual category. The practice in the

Directorate, separately for each of the subject countries, is as follows:

(i) In case there are co-operative exporter, the export price for residual category

is determined as the NEP which is the lowest of the co-operative exporters.

(ii) In case no exporter has been declared co-operative or there is no response,

the NEP is determined from DGCI&S data on weighted average basis.

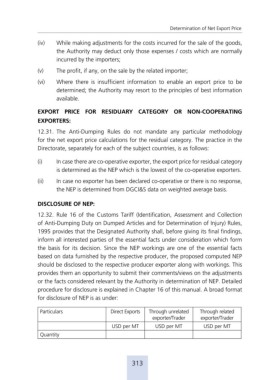

DISCLOSURE OF NEP:

12.32. Rule 16 of the Customs Tariff (Identification, Assessment and Collection

of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules,

1995 provides that the Designated Authority shall, before giving its final findings,

inform all interested parties of the essential facts under consideration which form

the basis for its decision. Since the NEP workings are one of the essential facts

based on data furnished by the respective producer, the proposed computed NEP

should be disclosed to the respective producer exporter along with workings. This

provides them an opportunity to submit their comments/views on the adjustments

or the facts considered relevant by the Authority in determination of NEP. Detailed

procedure for disclosure is explained in Chapter 16 of this manual. A broad format

for disclosure of NEP is as under:

Particulars Direct Exports Through unrelated Through related

exporter/Trader exporter/Trader

USD per MT USD per MT USD per MT

Quantity

313