Page 6 - Demo

P. 6

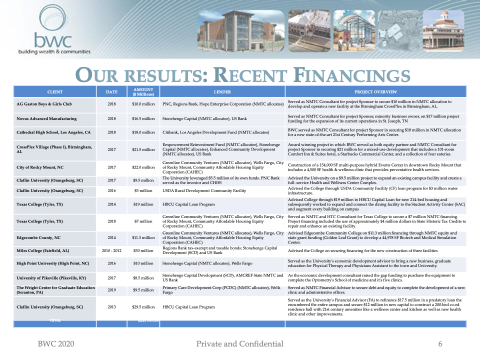

OUR RESULTS: RECENT FINANCINGS

AG Gaston Boys & Girls Club

Novus Advanced Manufacturing

Texas College (Tyler, TX)

Texas College (Tyler, TX)

Edgecombe County, NC

Miles College (Fairfield, AL)

CLIENT

Cathedral High School, Los Angeles, CA

CrossPlex Village (Phase I), Birmingham, AL

City of Rocky Mount, NC

Claflin University (Orangeburg, SC)

Claflin University (Orangeburg, SC)

High Point University (High Point, NC)

University of Pikeville (Pikeville, KY)

The Wright Center for Graduate Education (Scranton, PA)

Claflin University (Orangeburg, SC)

TOTAL

DATE

2018

2018

2018

2017

2017

2017

2016

2014

2018

2014

2010 - 2012

2016

2017

2019

2013

AMOUNT ($ Millions)

$10.0 million

$16.5 million

$18.0 million

$21.5 million

$22.0 million

$9.5 million

$3 million

$19 million

$7 million

$11.3 million

$30 million

$10 million

$8.5 million

$9.5 million

$29.5 million

$225 Million

USDA Rural Development Community Facility

HBCU Capital Loan Program

LENDER

PNC, Regions Bank, Hope Enterprise Corporation (NMTC allocatee)

Stonehenge Capital (NMTC allocatee), US Bank

Citibank, Los Angeles Development Fund (NMTC allocatee)

Empowerment Reinvestment Fund (NMTC allocatee), Stonehenge Capital (NMTC allocatee), Enhanced Community Development (NMTC allocatee), US Bank

Greenline Community Ventures (NMTC allocatee), Wells Fargo, City of Rocky Mount, Community Affordable Housing Equity Corporation (CAHEC)

The University leveraged $5.5 million of its own funds. PNC Bank served as the investor and CHHS

Greenline Community Ventures (NMTC allocatee), Wells Fargo, City of Rocky Mount, Community Affordable Housing Equity Corporation (CAHEC)

Greenline Community Ventures (NMTC allocatee), Wells Fargo, City of Rocky Mount, Community Affordable Housing Equity Corporation (CAHEC)

Regions Bank tax-exempt and taxable bonds; Stonehenge Capital Development (SCD) and US Bank

Stonehenge Capital (NMTC allocatee), Wells Fargo

Stonehenge Capital Development (SCD), AMCREF State NMTC and US Bank

Primary Care Development Corp (PCDC) (NMTC allocatee), Wells Fargo

HBCU Capital Loan Program

PROJECT OVERVIEW

Served as NMTC Consultant for project Sponsor to secure $10 million in NMTC allocation to develop and operate a new facility at the Birmingham CrossPlex in Birmingham, AL.

Served as NMTC Consultant for project Sponsor, minority business owner, on $17 million project funding for the expansion of its current operations in St. Joseph, TN

BWC served as NMTC Consultant for project Sponsor in securing $18 million in NMTC allocation for a new state-of-the-art 21st Century Performing Arts Center.

Award winning project in which BWC served as both equity partner and NMTC Consultant for project Sponsor in securing $21 million for a mixed-use development that includes a 101-room Comfort Inn & Suites hotel, a Starbucks Commercial Center, and a collection of four eateries.

Construction of a 154,000 SF multi-purpose hybrid Events Center in downtown Rocky Mount that includes a 4,500 SF health & wellness clinic that provides preventative health services.

Advised the University on a $9.5 million project to expand an existing campus facility and create a full- service Health and Wellness Center Complex.

Advised the College through USDA Community Facility (CF) loan program for $3 million water infrastructure.

Advised College through $19 million in HBCU Capital Loan for new 214-bed housing and subsequently worked to expand and connect the dining facility to the Student Activity Center (SAC) and augment every building on campus

Advised Edgecombe Community College on $11.3 million financing through NMTC equity and state grant funding (Golden Leaf Grant) to develop a 44,978 SF Biotech and Medical Simulation Center.

Advised the College on securing financing for the new construction of three facilities

Served as the University's economic development advisor to bring a new business, graduate education for Physical Therapy and Physicians Assistant to the town and University.

As the economic development consultant raised the gap funding to purchase the equipment to complete the Optometry's School of medicine and it's five clinics.

Served as NMTC Financial Advisor to secure debt and equity to complete the development of a new clinic and administrative offices.

Served as the University's Financial Advisor (FA) to refinance $17.5 million in a predatory loan the encumbered the entire campus and secure $12 million in new capital to construct a 200-bed co-ed residence hall with 21st century amenities like a wellness center and kitchen as well as new health clinic and other improvements.

Served as NMTC and HTC Consultant for Texas College to secure a $7 million NMTC financing. Project financing included the use of approximately $4 million dollars in State Historic Tax Credits to repair and enhance an existing facility.

BWC 2020 Private and Confidential

6