Page 748 - outbind://23/

P. 748

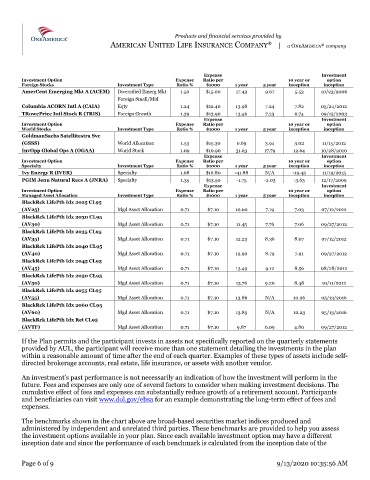

Products and financial services provided by

AMERICAN UNITED LIFE INSURANCE COMPANY Ò | a ONEAMERICA ® company

Expense Investment

Investment Option Expense Ratio per 10 year or option

Foreign Stocks Investment Type Ratio % $1000 1 year 5 year inception inception

AmerCent Emerging Mkt A (ACEM) Diversified Emerg Mkt 1.50 $15.00 17.43 9.67 5.53 10/23/2006

Foreign Small/Mid

Columbia ACORN Intl A (CAIA) Eqty 1.24 $12.40 13.98 7.24 7.82 05/24/2012

TRowePrice Intl Stock R (TRIS) Foreign Growth 1.39 $13.90 13.46 7.23 6.74 09/15/2003

Expense Investment

Investment Option Expense Ratio per 10 year or option

World Stocks Investment Type Ratio % $1000 1 year 5 year inception inception

GoldmanSachs Satellitestra Svc

(GSSS) World Allocation 1.53 $15.30 0.69 3.94 3.02 11/15/2012

InvOpp Global Ops A (OGAA) World Stock 1.09 $10.90 31.63 17.79 12.64 10/28/2010

Expense Investment

Investment Option Expense Ratio per 10 year or option

Specialty Investment Type Ratio % $1000 1 year 5 year inception inception

Ivy Energy R (IVER) Specialty 1.68 $16.80 -41.88 N/A -19.45 11/19/2015

PGIM Jenn Natural Recs A (JNRA) Specialty 1.35 $13.50 -1.75 -2.03 -3.63 12/17/2009

Expense Investment

Investment Option Expense Ratio per 10 year or option

Managed Asset Allocation Investment Type Ratio % $1000 1 year 5 year inception inception

BlackRck LifePth Idx 2025 CL95

(AV25) Mgd Asset Allocation 0.71 $7.10 10.60 7.19 7.03 07/12/2012

BlackRck LifePth Idx 2030 CL95

(AV30) Mgd Asset Allocation 0.71 $7.10 11.45 7.76 7.06 09/27/2012

BlackRck LifePth Idx 2035 CL95

(AV35) Mgd Asset Allocation 0.71 $7.10 12.23 8.36 8.07 07/12/2012

BlackRck LifePth Idx 2040 CL95

(AV40) Mgd Asset Allocation 0.71 $7.10 12.90 8.79 7.91 09/27/2012

BlackRck LifePth Idx 2045 CL95

(AV45) Mgd Asset Allocation 0.71 $7.10 13.49 9.12 8.56 08/28/2012

BlackRck LifePth Idx 2050 CL95

(AV50) Mgd Asset Allocation 0.71 $7.10 13.76 9.20 8.48 10/11/2012

BlackRck LifePth Idx 2055 CL95

(AV55) Mgd Asset Allocation 0.71 $7.10 13.86 N/A 10.26 05/13/2016

BlackRck LifePth Idx 2060 CL95

(AV60) Mgd Asset Allocation 0.71 $7.10 13.85 N/A 10.23 05/13/2016

BlackRck LifePth Idx Ret CL95

(AVTF) Mgd Asset Allocation 0.71 $7.10 9.87 6.09 4.80 09/27/2012

If the Plan permits and the participant invests in assets not specifically reported on the quarterly statements

provided by AUL, the participant will receive more than one statement detailing the investments in the plan

within a reasonable amount of time after the end of each quarter. Examples of these types of assets include self-

directed brokerage accounts, real estate, life insurance, or assets with another vendor.

An investment’s past performance is not necessarily an indication of how the investment will perform in the

future. Fees and expenses are only one of several factors to consider when making investment decisions. The

cumulative effect of fees and expenses can substantially reduce growth of a retirement account. Participants

and beneficiaries can visit www.dol.gov/ebsa for an example demonstrating the long-term effect of fees and

expenses.

The benchmarks shown in the chart above are broad-based securities market indices produced and

administered by independent and unrelated third parties. These benchmarks are provided to help you assess

the investment options available in your plan. Since each available investment option may have a different

inception date and since the performance of each benchmark is calculated from the inception date of the

Page 6 of 9 9/13/2020 10:35:56 AM