Page 52 - financial-literacy-pamphlets-sample

P. 52

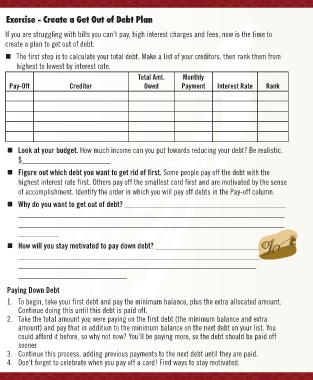

Is Your Debt Out of Control? Exercise - Create a Get Out of Debt Plan

Maxed out credit cards, making late payments, If you are struggling with bills you can’t pay, high interest charges and fees, now is the time to

paying only the minimum balance, and having create a plan to get out of debt.

larger minimums than you can afford are just The first step is to calculate your total debt. Make a list of your creditors, then rank them from

signs that your credit card use and debt is out 5 Habits to Change highest to lowest by interest rate.

of control. Here are some other signs that you Before Getting Out of Debt Total Amt. Monthly

may need help. Pay-Off Creditor Owed Payment Interest Rate Rank

Not having an emergency fund- something 1. Face your debt – Remember the debt

happens, an accident or job loss, and ratio? Work to keep your debt at 28% or

suddenly your credit is being used to pay less of your income.

monthly bills 2. Stop taking on new debt– Don’t get new

You have an accident and don’t have cards because you want the credit to pay

enough insurance, you’re not covered, or on something else. Look at your budget. How much income can you put towards reducing your debt? Be realistic.

your deductible is too high $______________________

You borrow against your retirement to buy a 3. Start a budget – If you can’t pay cash, Figure out which debt you want to get rid of first. Some people pay off the debt with the

house - now you're dipping into savings to don’t buy it. highest interest rate first. Others pay off the smallest card first and are motivated by the sense

pay bills 4. Live within your means – Don’t let your of accomplishment. Identify the order in which you will pay off debts in the Pay-off column.

Your multiple credit cards are charged to spending (with credit) exceed your monthly Why do you want to get out of debt? ________________________________________

the max and you’re getting new cards to income. __________________________________________________________________

help pay the existing ones __________________________________________________________________

5. Know the difference between wants and

The economy has a downturn, the value of needs – Always ask the question “do I __________

your savings and investments are worth How will you stay motivated to pay down debt? __________________________

½ of what they were. Now you’re having to really need this?” ____________________________________________________________

borrow from retirement to make ends meet ___________________________________________________________

You lose your job, and when you find a new ___________________________

position it is paying 1/3 less. Now you’re Shift Your Thinking

borrowing against your credit to make your Paying Down Debt

mortgage. Many people see credit as extra money they have 1. To begin, take your first debt and pay the minimum balance, plus the extra allocated amount.

to spend. Instead, see credit as a convenient way Continue doing this until this debt is paid off.

You impulse buy on items, rack up credit of making purchases with the money you have. 2. Take the total amount you were paying on the first debt (the minimum balance and extra

card debt, then pay the minimum balances. Get into the habit of paying off your credit cards amount) and pay that in addition to the minimum balance on the next debt on your list. You

Your education loans are due and you don’t each month. could afford it before, so why not now? You’ll be paying more, so the debt should be paid off

sooner.

have a job. Protect your credit and use it wisely. 3. Continue this process, adding previous payments to the next debt until they are paid.

4. Don’t forget to celebrate when you pay off a card! Find ways to stay motivated.