Page 284 - MANUAL OF SOP

P. 284

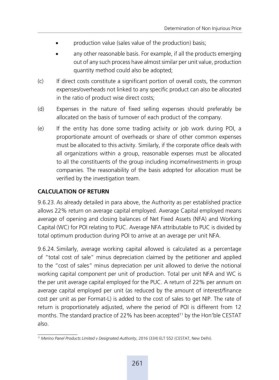

Determination of Non Injurious Price

• production value (sales value of the production) basis;

• any other reasonable basis. For example, if all the products emerging

out of any such process have almost similar per unit value, production

quantity method could also be adopted;

(c) If direct costs constitute a significant portion of overall costs, the common

expenses/overheads not linked to any specific product can also be allocated

in the ratio of product wise direct costs;

(d) Expenses in the nature of fixed selling expenses should preferably be

allocated on the basis of turnover of each product of the company.

(e) If the entity has done some trading activity or job work during POI, a

proportionate amount of overheads or share of other common expenses

must be allocated to this activity. Similarly, if the corporate office deals with

all organizations within a group, reasonable expenses must be allocated

to all the constituents of the group including income/investments in group

companies. The reasonability of the basis adopted for allocation must be

verified by the investigation team.

CALCULATION OF RETURN

9.6.23. As already detailed in para above, the Authority as per established practice

allows 22% return on average capital employed. Average Capital employed means

average of opening and closing balances of Net Fixed Assets (NFA) and Working

Capital (WC) for POI relating to PUC. Average NFA attributable to PUC is divided by

total optimum production during POI to arrive at an average per unit NFA.

9.6.24. Similarly, average working capital allowed is calculated as a percentage

of “total cost of sale” minus depreciation claimed by the petitioner and applied

to the “cost of sales” minus depreciation per unit allowed to derive the notional

working capital component per unit of production. Total per unit NFA and WC is

the per unit average capital employed for the PUC. A return of 22% per annum on

average capital employed per unit (as reduced by the amount of interest/finance

cost per unit as per Format-L) is added to the cost of sales to get NIP. The rate of

return is proportionately adjusted, where the period of POI is different from 12

11

months. The standard practice of 22% has been accepted by the Hon’ble CESTAT

also.

11 Merino Panel Products Limited v Designated Authority, 2016 (334) ELT 552 (CESTAT, New Delhi).

261