Page 13 - your_guide_to_reverse_mortgages

P. 13

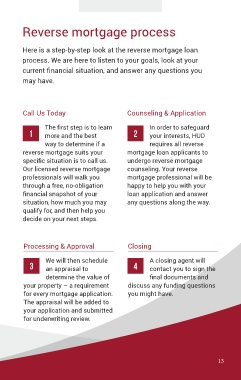

Reverse mortgage process

Here is a step-by-step look at the reverse mortgage loan

process. We are here to listen to your goals, look at your

current financial situation, and answer any questions you

may have.

Call Us Today Counseling & Application

The first step is to learn In order to safeguard

1 more and the best 2 your interests, HUD

way to determine if a requires all reverse

reverse mortgage suits your mortgage loan applicants to

specific situation is to call us. undergo reverse mortgage

Our licensed reverse mortgage counseling. Your reverse

professionals will walk you mortgage professional will be

through a free, no-obligation happy to help you with your

financial snapshot of your loan application and answer

situation, how much you may any questions along the way.

qualify for, and then help you

decide on your next steps.

Processing & Approval Closing

We will then schedule A closing agent will

3 an appraisal to 4 contact you to sign the

determine the value of final documents and

your property – a requirement discuss any funding questions

for every mortgage application. you might have.

The appraisal will be added to

your application and submitted

for underwriting review.

13 13