Page 15 - 2020 McLennan County Benefits Enrollment Guide

P. 15

Health Savings Accounts (HSA)

Another account available to fund your out-of-pocket expenses is a Health Savings Account (HSA). If you participate in

the Consumer Driven Health Plan (CDHP) and do not have other non-qualified health plan coverage*, you can set money

aside in a Health Savings Account (HSA) before taxes are deducted to pay for eligible medical, dental and vision

expenses. An HSA is similar to a flexible spending account in that you can pay for health care expenses with pre-tax

dollars. There are several advantages of an HSA. For instance, money in an HSA can be invested much like 401(k) funds

are invested.

As per IRS regulations you cannot participate in both a HSA and FSA at the same time. The maximum annual amount

that you can contribute to a HSA for 2020 is $3,550 for individual coverage and $7,100 for family coverage.

Additionally, if you are age 55 or older, you may make an additional annual “catch-up” contribution of $1,000.

Unused money in an HSA account is not forfeited at the end of the year and is carried forward. Also, your HSA account is

yours to keep which means that you can take it with you if you change jobs or retire. If you have any money remaining in

your HSA after your retirement, you may withdraw the money as cash subject to income taxes or penalties if applicable

(Refer to IRS Publication 969).

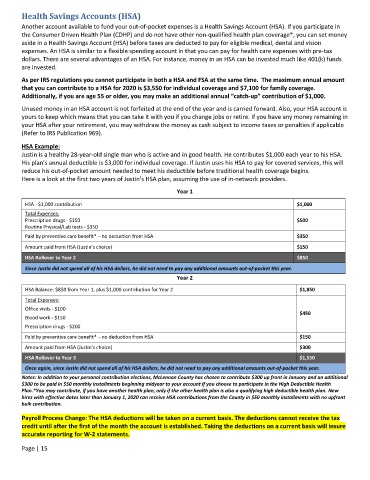

HSA Example:

Justin is a healthy 28-year-old single man who is active and in good health. He contributes $1,000 each year to his HSA.

His plan’s annual deductible is $3,000 for individual coverage. If Justin uses his HSA to pay for covered services, this will

reduce his out-of-pocket amount needed to meet his deductible before traditional health coverage begins.

Here is a look at the first two years of Justin’s HSA plan, assuming the use of in-network providers.

Year 1

HSA - $1,000 contribution $1,000

Total Expenses:

Prescription drugs - $150 $500

Routine Physical/Lab tests - $350

Paid by preventive care benefit* – no deduction from HSA $350

Amount paid from HSA (Justin’s choice) $150

HSA Rollover to Year 2 $850

Since Justin did not spend all of his HSA dollars, he did not need to pay any additional amounts out-of-pocket this year.

Year 2

HSA Balance: $850 from Year 1, plus $1,000 contribution for Year 2 $1,850

Total Expenses:

Office visits - $100

Blood work - $150 $450

Prescription drugs - $200

Paid by preventive care benefit* – no deduction from HSA $150

Amount paid from HSA (Justin’s choice) $300

HSA Rollover to Year 3 $1,550

Once again, since Justin did not spend all of his HSA dollars, he did not need to pay any additional amounts out-of-pocket this year.

Notes: In addition to your personal contribution elections, McLennan County has chosen to contribute $300 up front in January and an additional

$300 to be paid in $50 monthly installments beginning midyear to your account if you choose to participate in the High Deductible Health

Plan.*You may contribute, if you have another health plan, only if the other health plan is also a qualifying high deductible health plan. New

hires with effective dates later than January 1, 2020 can receive HSA contributions from the County in $50 monthly installments with no upfront

bulk contribution.

Payroll Process Change: The HSA deductions will be taken on a current basis. The deductions cannot receive the tax

credit until after the first of the month the account is established. Taking the deductions on a current basis will insure

accurate reporting for W-2 statements.

Page | 15