Page 18 - New Allen Alliance Digital Book

P. 18

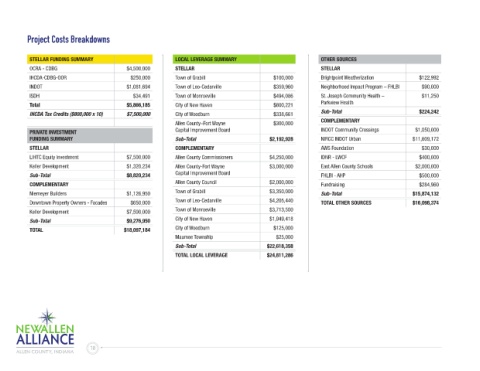

Project Costs Breakdowns

STELLAR FUNDING SUMMARY LOCAL LEVERAGE SUMMARY OTHER SOURCES

OCRA - CDBG $4,500,000 STELLAR STELLAR

IHCDA-CDBG-OOR $250,000 Town of Grabill $100,000 Brightpoint Weatherization $122,992

INDOT $1,081,694 Town of Leo-Cedarville $359,960 Neighborhood Impact Program – FHLBI $90,000

ISDH $34,491 Town of Monroeville $494,086 St. Joseph Community Health – $11,250

Total $5,866,185 City of New Haven $600,221 Parkview Health

IHCDA Tax Credits ($800,000 x 10) $7,500,000 City of Woodburn $338,661 Sub-Total $224,242

Allen County–Fort Wayne $300,000 COMPLEMENTARY

PRIVATE INVESTMENT Capital Improvement Board INDOT Community Crossings $1,050,000

FUNDING SUMMARY Sub-Total $2,192,928 NIRCC INDOT Urban $11,609,172

STELLAR COMPLEMENTARY AWS Foundation $30,000

LIHTC Equity Investment $7,500,000 Allen County Commissioners $4,250,000 IDNR - LWCF $400,000

Keller Development $1,320,234 Allen County-Fort Wayne $3,000,000 East Allen County Schools $2,000,000

Sub-Total $8,820,234 Capital Improvement Board FHLBI - AHP $500,000

COMPLEMENTARY Allen County Council $2,000,000 Fundraising $284,960

Niemeyer Builders $1,126,950 Town of Grabill $3,350,000 Sub-Total $15,874,132

Downtown Property Owners - Facades $650,000 Town of Leo-Cedarville $4,205,440 TOTAL OTHER SOURCES $16,098,374

Keller Development $7,500,000 Town of Monroeville $3,713,500

Sub-Total $9,276,950 City of New Haven $1,949,418

TOTAL $18,097,184 City of Woodburn $125,000

Maumee Township $25,000

Sub-Total $22,618,358

TOTAL LOCAL LEVERAGE $24,811,286

18

EARR PLAN.indd 18 11/13/18 10:47 AM