Page 227 - Kolte Patil AR 2019-20

P. 227

Notes forming part of the Consolidated Financial Statements

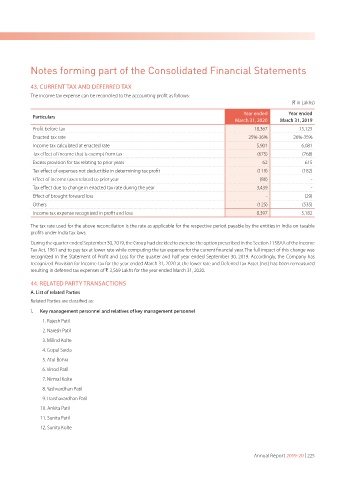

43. CURRENT TAX AND DEFERRED TAX

The income tax expense can be reconciled to the accounting profit as follows:

(H in Lakhs)

Year ended Year ended

Particulars

March 31, 2020 March 31, 2019

Profit before tax 18,367 15,123

Enacted tax rate 25%-36% 26%-35%

Income tax calculated at enacted rate 5,901 6,081

Tax effect of income that is exempt from tax (675) (768)

Excess provision for tax relating to prior years 62 615

Tax effect of expenses not deductible in determining tax profit (119) (182)

Effect of income taxes related to prior year (86) -

Tax effect due to change in enacted tax rate during the year 3,439 -

Effect of brought forward loss - (29)

Others (125) (535)

Income tax expense recognized in profit and loss 8,397 5,182

The tax rate used for the above reconciliation is the rate as applicable for the respective period payable by the entities in India on taxable

profits under India tax laws.

During the quarter ended September 30, 2019, the Group had decided to exercise the option prescribed in the Section 115BAA of the Income

Tax Act, 1961 and to pay tax at lower rate while computing the tax expense for the current financial year. The full impact of this change was

recognized in the Statement of Profit and Loss for the quarter and half year ended September 30, 2019. Accordingly, the Company has

recognized Provision for lncome Tax for the year ended March 31, 2020 at the lower rate and Deferred Tax Asset (net) has been remeasured

resulting in deferred tax expenses of ` 3,569 Lakhs for the year ended March 31, 2020.

44. RELATED PARTY TRANSACTIONS

A. List of related Parties

Related Parties are classified as:

i. Key management personnel and relatives of key management personnel

1. Rajesh Patil

2. Naresh Patil

3. Milind Kolte

4. Gopal Sarda

5. Atul Bohra

6. Vinod Patil

7. Nirmal Kolte

8. Yashvardhan Patil

9. Harshavardhan Patil

10. Ankita Patil

11. Sunita Patil

12. Sunita Kolte

Annual Report 2019-20 | 225