Page 282 - BCML AR 2019-20

P. 282

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures

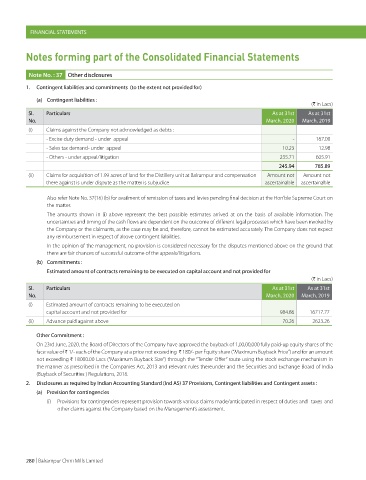

1. Contingent liabilities and commitments (to the extent not provided for)

(a) Contingent liabilities :

(H in Lacs)

Sl. Particulars As at 31st As at 31st

No. March, 2020 March, 2019

(i) Claims against the Company not acknowledged as debts :

- Excise duty demand - under appeal - 167.00

- Sales tax demand- under appeal 10.23 12.98

- Others - under appeal/litigation 235.71 605.91

245.94 785.89

(ii) Claims for acquisition of 1.99 acres of land for the Distillery unit at Balrampur and compensation Amount not Amount not

there against is under dispute as the matter is subjudice ascertainable ascertainable

Also refer Note No. 37(16) (b) for availment of remission of taxes and levies pending final decision at the Hon’ble Supreme Court on

the matter.

The amounts shown in (i) above represent the best possible estimates arrived at on the basis of available information. The

uncertainties and timing of the cash flows are dependent on the outcome of different legal processes which have been invoked by

the Company or the claimants, as the case may be and, therefore, cannot be estimated accurately. The Company does not expect

any reimbursement in respect of above contingent liabilities.

In the opinion of the management, no provision is considered necessary for the disputes mentioned above on the ground that

there are fair chances of successful outcome of the appeals/litigations.

(b) Commitments :

Estimated amount of contracts remaining to be executed on capital account and not provided for

(H in Lacs)

Sl. Particulars As at 31st As at 31st

No. March, 2020 March, 2019

(i) Estimated amount of contracts remaining to be executed on

capital account and not provided for 984.86 16717.77

(ii) Advance paid against above 70.26 2623.26

Other Commitment :

On 23rd June, 2020, the Board of Directors of the Company have approved the buyback of 1,00,00,000 fully paid-up equity shares of the

face value of H 1/- each of the Company at a price not exceeding H 180/- per Equity share (“Maximum Buyback Price”) and for an amount

not exceeding H 18000.00 Lacs (“Maximum Buyback Size”) through the “Tender Offer” route using the stock exchange mechanism in

the manner as prescribed in the Companies Act, 2013 and relevant rules thereunder and the Securities and Exchange Board of India

(Buyback of Securities ) Regulations, 2018.

2. Disclosures as required by Indian Accounting Standard (Ind AS) 37 Provisions, Contingent liabilities and Contingent assets :

(a) Provision for contingencies

(i) Provisions for contingencies represent provision towards various claims made/anticipated in respect of duties and taxes and

other claims against the Company based on the Management’s assessment.

280 | Balrampur Chini Mills Limited