Page 5 - Layout 1

P. 5

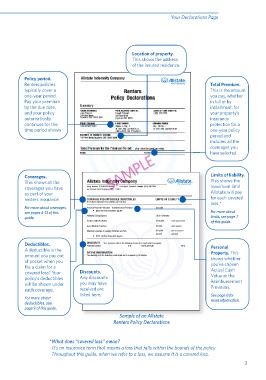

Your Declarations Page

Location of property.

This shows the address

of the insured residence.

Policy period.

Renters policies Total Premium.

typically cover a This is the amount

one-year period. you pay, whether

Pay your premium in full or by

by the due date, installment, for

and your policy your property’s

automatically insurance

continues for the protection for a

time period shown. one-year policy

period and

includes all the

coverages you

have selected.

Coverages. Limits of liability.

This shows all the This shows the

coverages you have Policy Number: 0 03 001234 09/01 Your Agent: Sample A. Sample (123) 456-7890 maximum limit

For Premium Period Beginning: Sep. 1 2010

as part of your Allstate will pay

for each covered

renters insurance. COVERAGE AND APPLICABLE DEDUCTIBLES LIMITS OF LIABILITY

(See Policy for ApplicableTerms,Conditions and Exclusions)

loss.*

For more about coverages, Personal Property Protection - Reimbursement Provision $70,200

•

see pages 4-13 of this $250 All Peril Deductible Applies For more about

Additional Living Expense Up to 12 Months limits, see page 7

guide.

Family Liability Protection $100,000 each occurrence of this guide.

Guest Medical Protection $1,000 each person

Extended Coverage on Jewelry, Watches and Furs $10,000 per occurrence

• $250 All Peril Deductible Applies $2,500 per item

Deductibles. DISCOUNTS Your premium re!ects the following discounts on applicable coverage(s): 20 % Personal

Protective Device

Home and Auto

5 %

A deductible is the

RATING INFORMATION Property. This

amount you pay out The dwelling is of Fire Resistive construction and is occupied by 16 families

shows whether

of pocket when you

you’ve chosen

file a claim for a Actual Cash

covered loss*. Your Discounts. Value or the

policy’s deductibles Any discounts Reimbursement

will be shown under you may have

each coverage. received are Provision.

listed here. See page 8 for

For more about more information.

deductibles, see

page 9 of this guide.

Sample of an Allstate

Renters Policy Declarations

*What does “covered loss” mean?

It’s an insurance term that means a loss that falls within the bounds of the policy.

Throughout this guide, when we refer to a loss, we assume it is a covered loss.

3