Page 467 - AR DPBM-2016--SMALL

P. 467

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

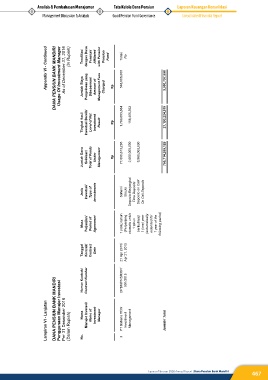

Appendix VI - Continued DANA PENSIUN BANK MANDIRI Usage Of Investment Manager As of December 31, 2016 (In Rupiah) Terafiliasi Jumlah Biaya dengan Dana Pengeloaan yang Pensiun/ Dibebankan/ Affiliated Amount of with Pension Management Fees Pension Charged Fund Rp Tidak/ 548,566,360 No 3,300,797,590

Tingkat Hasil Investasi Bersih/ Level of Net Investment Result Rp 1,780,553,684 118,406,562 27,193,224,919

Jumlah Dana Kelolaan/ Total of Funds Under Management Rp 77,696,613,285 2,000,000,000 3,980,000,000 755,714,269,125

Jenis Investasi/ Type of Investments Saham/ Stocks Deposito Berjangka/ Time Deposits Deposito on Call/ On Call Deposits

Masa Perjanjian/ Period of Agreement 1 (satu) tahun (Perpanjang otomatis untuk 1 tahun berikutnya)/ 1 (one) year (automatically extended for 1 year of the following period)

Tanggal Nomor Kontrak/ Kontrak/ Contract Number Contract Date 21 Apr 2015/ DPBM/PKS/KOP/ Apr 21, 2015 001/2015

Lampiran VI - Lanjutan DANA PENSIUN BANK MANDIRI Penggunaan Manajer Investasi Per 31 Desember 2016 (Dalam Rupiah) Nama Manajer Invetasi/ Name of Investment Manager PT Bahana TCW Investment Management Jumlah/ Total

No. 3

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

467