Page 480 - AR DPBM-2016--SMALL

P. 480

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

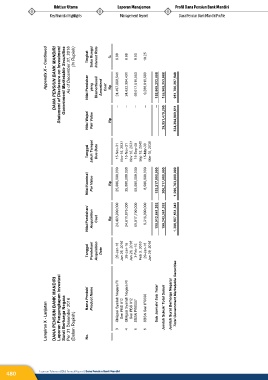

Appendix X – Continued DANA PENSIUN BANK MANDIRI Statement of Disclosure on Investment Government Marketable Securities As of December 31, 2016 (In Rupiah) Tingkat Nilai Perolehan Suku Bunga/ yang Interest Rate Diamortisasi/ Amortized Cost % Rp 8.88 24,497,808,541 -- 8.88 24,622,394,431 -- 9.00 59,017,515,553 -- 10.25 9,288,910,580 -- 155,909,253,888 -- 155,909,253,888 951,700,297,548

Tanggal Nilai Wajar/ Fair Value Jatuh Tempo/ Due Date Rp 15-Nov-31 Nov 15, 2031 15-Nov-31 Nov 15, 2031 15-Sep-40 Sep 15, 2040 15-Mar-30 Mar 15, 2030 39,951,479,200 334,394,909,611

Nilai Nominal/ Par Value Rp 25,000,000,000 25,000,000,000 59,000,000,000 8,500,000,000 155,217,000,000 200,217,000,000 1,290,763,000,000

Nilai Perolehan/ Acquisition Cost Rp 24,483,900,000 24,611,875,000 59,017,700,000 9,316,000,000 155,912,641,202 199,243,361,202 1,306,507,531,342

Tanggal Perolehan/ Acquisition Date 26-Jan-16 Jan 26, 2016 26-Jan-16 Jan 26, 2016 3-Feb-16 Feb 3, 2016 29-Jan-16 Jan 29, 2016

Lampiran X - Lanjutan DANA PENSIUN BANK MANDIRI Laporan Pengungkapan Investasi Surat Berharga Negara Per 31 Desember 2016 (Dalam Rupiah) Nama Produk/ Product Name Obligasi Syariah Negara RI 3 Seri PBS 012 Obligasi Syariah Negara RI 4 Seri PBS 012 SBSN PBS007 5 SBSN Seri IF0006 6 Sub Jumlah/ Sub Total Jumlah Sukuk/ Total Sukuk Jumlah Surat Berharga Negara/ Total Government Marketable Securities

No.

480 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri