Page 5 - AAG126_H4P Realtors_Brad Dela Cruz

P. 5

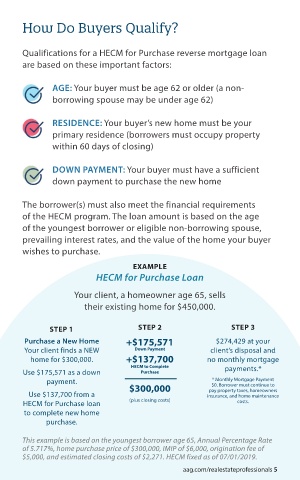

How Do Buyers Qualify?

Qualifications for a HECM for Purchase reverse mortgage loan

are based on these important factors:

AGE: Your buyer must be age 62 or older (a non-

borrowing spouse may be under age 62)

RESIDENCE: Your buyer’s new home must be your

primary residence (borrowers must occupy property

within 60 days of closing)

DOWN PAYMENT: Your buyer must have a sufficient

down payment to purchase the new home

The borrower(s) must also meet the financial requirements

of the HECM program. The loan amount is based on the age

of the youngest borrower or eligible non-borrowing spouse,

prevailing interest rates, and the value of the home your buyer

wishes to purchase.

EXAMPLE

HECM for Purchase Loan

Your client, a homeowner age 65, sells

their existing home for $450,000.

STEP 1 STEP 2 STEP 3

Purchase a New Home +$175,571 $274,429 at your

Your client finds a NEW Down Payment client’s disposal and

home for $300,000. +$137,700 no monthly mortgage

HECM to Complete payments.*

Use $175,571 as a down Purchase

* Monthly Mortgage Payment

payment. $0. Borrower must continue to

pay property taxes, homeowners

Use $137,700 from a $300,000 insurance, and home maintenance

HECM for Purchase loan (plus closing costs) costs.

to complete new home

purchase.

This example is based on the youngest borrower age 65, Annual Percentage Rate

of 5.717%, home purchase price of $300,000, IMIP of $6,000, origination fee of

$5,000, and estimated closing costs of $2,271. HECM fixed as of 07/01/2019.

5 aag.com/realestateprofessionals 5