Page 2 - B2BAAG14_Builders Stacked Presentation

P. 2

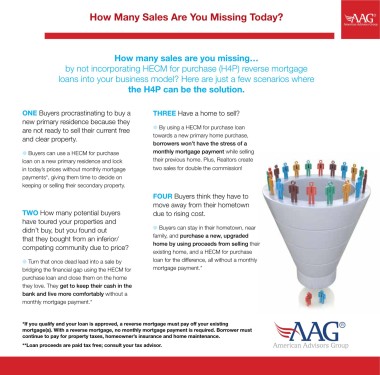

How Many Sales Are You Missing Today?

How many sales are you missing…

by not incorporating HECM for purchase (H4P) reverse mortgage

loans into your business model? Here are just a few scenarios where

the H4P can be the solution.

ONE Buyers procrastinating to buy a THREE Have a home to sell?

new primary residence because they

are not ready to sell their current free l By using a HECM for purchase loan

and clear property. towards a new primary home purchase,

borrowers won’t have the stress of a

l Buyers can use a HECM for purchase monthly mortgage payment while selling

loan on a new primary residence and lock their previous home. Plus, Realtors create

in today’s prices without monthly mortgage two sales for double the commission!

payments*, giving them time to decide on

keeping or selling their secondary property.

FOUR Buyers think they have to

move away from their hometown

TWO How many potential buyers due to rising cost.

have toured your properties and

didn’t buy, but you found out l Buyers can stay in their hometown, near

that they bought from an inferior/ family, and purchase a new, upgraded

competing community due to price? home by using proceeds from selling their

existing home, and a HECM for purchase

l Turn that once dead lead into a sale by loan for the difference, all without a monthly

bridging the financial gap using the HECM for mortgage payment.*

purchase loan and close them on the home

they love. They get to keep their cash in the

bank and live more comfortably without a

monthly mortgage payment.*

*If you qualify and your loan is approved, a reverse mortgage must pay off your existing

mortgage(s). With a reverse mortgage, no monthly mortgage payment is required. Borrower must

continue to pay for property taxes, homeowner’s insurance and home maintenance.

**Loan proceeds are paid tax free; consult your tax advisor.