Page 63 - IBC Orders us 7-CA Mukesh Mohan

P. 63

Order Passed Under Sec 7

Hon’ble NCLT Principal Bench

2. Sometimes in the history of a nation evolutionary processes are perfected so as to usher in

financial stability by striking at the elements of uncertainty. To achieve the object Insolvency and

Bankruptcy Code, 2016 has been enacted (for brevity 'IBC'). The problems of ever increasing Non-

performing assets is attempted to be resolved in a time bound manner for maximisation of value of assets,

inter alia, in respect of Corporate persons and also to promote entrepreneurship, availability of credit and

balancing the interests of, and alteration in, the order of priority of Government dues.

3. Taking advantage of the IBC, the present petition has been filed by the State Bank of India under

Section 7 thereof in the matter of Bhushan Steel Limited (for brevity 'the Financial Debtor') with a prayer

to initiate Corporate Insolvency Resolution Process. The Financial Debtor has its registered office at

Bhushan Centre, Ground Floor, Hyatt Regency Complex, Bhikaji Cama Place, New Delhi. The petitioner

has also proposed the name of Interim Resolution Professional Mr. Vijay Kumar V. Iyer (IBBI/IPA-

001/IP-P00261/2017-18/10490). He has also filed a declaration stating that he was eligible to be

appointed as Interim Resolution Professional in respect of the Financial Debtor in accordance with the

provisions of Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate

persons) Regulations, 2016. The petition was filed on 03.07.2017 and the pleadings have been completed.

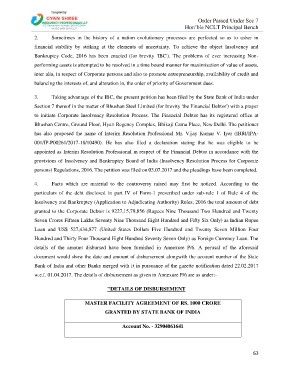

4. Facts which are material to the controversy raised may first be noticed. According to the

particulars of the debt disclosed in part IV of Form-1 prescribed under sub-rule 1 of Rule 4 of the

Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016 the total amount of debt

granted to the Corporate Debtor is 9227,15,79,856 (Rupees Nine Thousand Two Hundred and Twenty

Seven Crores Fifteen Lakhs Seventy Nine Thousand Eight Hundred and Fifty Six Only) as Indian Rupee

Loan and US$ 527,434,877 (United States Dollars Five Hundred and Twenty Seven Million Four

Hundred and Thirty Four Thousand Eight Hundred Seventy Seven Only) as Foreign Currency Loan. The

details of the amount disbursed have been furnished in Annexure P/6. A perusal of the aforesaid

document would show the date and amount of disbursement alongwith the account number of the State

Bank of India and other Banks merged with it in pursuance of the gazette notification dated 22.02.2017

w.e.f. 01.04.2017. The details of disbursement as given in Annexure P/6 are as under:-

"DETAILS OF DISBURSEMENT

MASTER FACILITY AGREEMENT OF RS. 1000 CRORE

GRANTED BY STATE BANK OF INDIA

Account No. - 32904061641

63