Page 77 - IBC Orders us 7-CA Mukesh Mohan

P. 77

Order Passed Under Sec 7

Hon’ble NCLT Principal Bench

Rs. 12,459 Crores. The accounts for the said facility are running accounts with disbursals on a regular

basis and the details for the same are reflected in the statement of accounts for the accounts maintained

with respect to the working capital consortium agreement dated 2 March 2015 and enclosed separately

with this Application."

5. A perusal of the aforesaid details of disbursement would show that the working capital has been

disbursed vide the working capital consortium agreement dated 02.03.2015 entered into inter alia between

the Corporate Debtor and the State Bank of India along with other associate Banks amalgamated with it

w.e.f. 01.04.2017 for the purpose of providing working capital to the Corporate Debtor upto a total limit

of Rs. 12,459 crores. The account for the said facility for running accounts with disbursal on a regular

basis and the details of the same have been reflected in the statement of account. For the accounts

maintained with respect to the working capital consortium agreement dated 02.03.2015 which have been

separately enclosed with the application.

6. In column 2 of part IV the amount claimed to be default and the date on which the default

occurred have been stated in the clear terms. According to the averments made by the Financial Creditor-

State Bank of India the facility availed by the Corporate Debtor are overdue and total amount in default is

Rs. 4390,75,41,611 (Indian Rupees Four Thousand Three Hundred Ninety Crores Seventy Five Lakhs

Forty One Thousand Six Hundred and Eleven Only) for the Indian Rupee Loans and US$ 49,684,877

(United States Dollars Forty Nine Million Six Hundred Eighty Four Thousand Eight Hundred and

Seventy Seven Only) towards the Foreign Currency Loan. The details with regard to the date, amount and

the days of default with respect to the facility granted by the Financial Creditor to the Corporate Debtor

have also been placed on record (Annexure P/7).

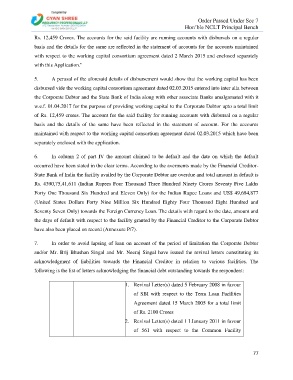

7. In order to avoid lapsing of loan on account of the period of limitation the Corporate Debtor

and/or Mr. Brij Bhushan Singal and Mr. Neeraj Singal have issued the revival letters constituting its

acknowledgment of liabilities towards the Financial Creditor in relation to various facilities. The

following is the list of letters acknowledging the financial debt outstanding towards the respondent:

1. Revival Letter(s) dated 5 February 2008 in favour

of SBI with respect to the Term Loan Facilities

Agreement dated 15 March 2005 for a total limit

of Rs. 2100 Crores

2. Revival Letter(s) dated 1 I January 2011 in favour

of 561 with respect to the Common Facility

77