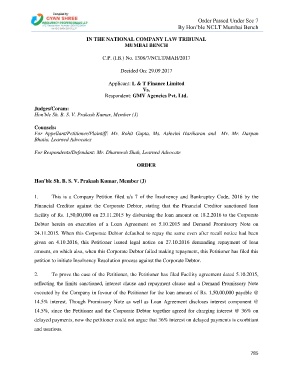

Page 785 - IBC Orders us 7-CA Mukesh Mohan

P. 785

Order Passed Under Sec 7

By Hon’ble NCLT Mumbai Bench

IN THE NATIONAL COMPANY LAW TRIBUNAL

MUMBAI BENCH

C.P. (I.B.) No. 1308/7/NCLT/MAH/2017

Decided On: 29.09.2017

Applicant: L & T Finance Limited

Vs.

Respondent: GMV Agencies Pvt. Ltd.

Judges/Coram:

Hon'ble Sh. B. S. V. Prakash Kumar, Member (J)

Counsels:

For Appellant/Petitioner/Plaintiff: Mr. Rohit Gupta, Ms. Ashwini Hariharan and Mr. Mr. Darpan

Bhatia, Learned Advocates

For Respondents/Defendant: Mr. Dharmesh Shah, Learned Advocate

ORDER

Hon'ble Sh. B. S. V. Prakash Kumar, Member (J)

1. This is a Company Petition filed u/s 7 of the Insolvency and Bankruptcy Code, 2016 by the

Financial Creditor against the Corporate Debtor, stating that the Financial Creditor sanctioned loan

facility of Rs. 1,50,00,000 on 23.11.2015 by disbursing the loan amount on 18.2.2016 to the Corporate

Debtor herein on execution of a Loan Agreement on 5.10.2015 and Demand Promissory Note on

24.11.2015. When this Corporate Debtor defaulted to repay the same even after recall notice had been

given on 4.10.2016, this Petitioner issued legal notice on 27.10.2016 demanding repayment of loan

amount, on which also, when this Corporate Debtor failed making repayment, this Petitioner has filed this

petition to initiate Insolvency Resolution process against the Corporate Debtor.

2. To prove the case of the Petitioner, the Petitioner has filed Facility agreement dated 5.10.2015,

reflecting the limits sanctioned, interest clause and repayment clause and a Demand Promissory Note

executed by the Company in favour of the Petitioner for the loan amount of Rs. 1,50,00,000 payable @

14.5% interest. Though Promissory Note as well as Loan Agreement discloses interest component @

14.5%, since the Petitioner and the Corporate Debtor together agreed for charging interest @ 36% on

delayed payments, now the petitioner could not argue that 36% interest on delayed payments is exorbitant

and usurious.

785