Page 811 - IBC Orders us 7-CA Mukesh Mohan

P. 811

Order Passed Under Sec 7

By Hon’ble NCLT New Delhi-II Bench

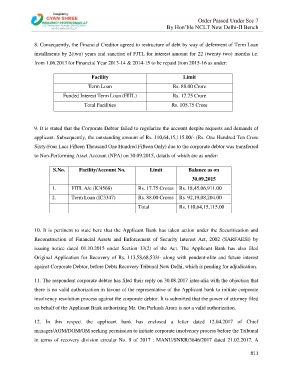

8. Consequently, the Financial Creditor agreed to restructure of debt by way of deferment of Term Loan

installments by 2(two) years and sanction of FJTL for interest amount for 22 (twenty two) months i.e.

from 1.06.2013 for Financial Year 2013-14 & 2014-15 to be repaid from 2015-16 as under:

Facility Limit

Term Loan Rs. 88.00 Crore

Funded Interest Term Loan (FITL) Rs. 17.75 Crore

Total Facilities Rs. 105.75 Crore

9. It is stated that the Corporate Debtor failed to regularize the account despite requests and demands of

applicant. Subsequently, the outstanding amount of Rs. 110,64,15,115.00/- (Rs. One Hundred Ten Crore

Sixty-Four Lacs Fifteen Thousand One Hundred Fifteen Only) due to the corporate debtor was transferred

to Non-Performing Asset Account (NPA) on 30.09.2015, details of which are as under:

S.No. Facility/Account No. Limit Balance as on

30.09.2015

1. FITL A/c (IC4568) Rs. 17.75 Crores Rs. 18,45,06,911.00

2. Term Loan (IC3347) Rs. 88.00 Crores Rs. 92,19,08,204.00

Total Rs. 110,64,15,115.00

10. It is pertinent to state here that the Applicant Bank has taken action under the Securitization and

Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) by

issuing notice dated 01.10.2015 under Section 13(2) of the Act. The Applicant Bank has also filed

Original Application for Recovery of Rs. 113,58,68,533/- along with pendent-elite and future interest

against Corporate Debtor, before Debts Recovery Tribunal New Delhi, which is pending for adjudication.

11. The respondent corporate debtor has filed their reply on 30.08.2017 inter-alia with the objection that

there is no valid authorization in favour of the representative of the Applicant bank to initiate corporate

insolvency resolution process against the corporate debtor. It is submitted that the power of attorney filed

on behalf of the Applicant Bank authorizing Mr. Om Parkash Arora is not a valid authorization.

12. In this respect the applicant bank has enclosed a letter dated 12.04.2017 of Chief

manager/AGM/DGM/GM seeking permission to initiate corporate insolvency process before the Tribunal

in terms of recovery division circular No. 9 of 2017 : MANU/SNKR/3646/2017 dated 21.02.2017. A

811