Page 31 - Town of Bedford FY 2018-2019 Budget.pdf

P. 31

&z ϮϬϭϴͲϮϬϭϵ KWd h ' d dKtE K& &KZ ͕ s/Z'/E/

Electric Rates: In accordance with Article II of the Municipal Code, the Town Manager has the authority

to evaluate the cost of electric operations and make recommendations to Town Council of a rate to be

as uniform as possible to cover such operations.

¾ Use of Prior Year Reserves – The cash balance carried over from the previous fiscal year to cover

expenditures in the current fiscal year.

¾ Revenue from Use of Money & Property – Revenue made on utility pole lease agreements.

¾ Sale of Electricity – Fees collected for electricity provided to residential and commercial

customers.

¾ Power Cost Adjustment – Rate adjustment for the leveling of electric charges.

¾ Gross Receipts Tax – This is the charge assessed to recover the miscellaneous gross receipts tax

imposed on retail electric providers operating in an incorporated city or town having a

population of more than 1,000.

¾ Other Non-Revenue Receipts – Interest collected on investments and utility deposits.

¾ Recoveries & Rebates – Reimbursement to the Electric Fund on items such as insurance claim

recoveries and other various expenditure refunds.

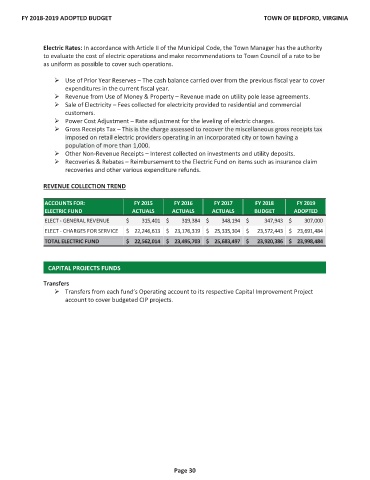

REVENUE COLLECTION TREND

ACCOUNTS FOR: FY 2015 FY 2016 FY 2017 FY 2018 FY 2019

ELECTRIC FUND ACTUALS ACTUALS ACTUALS BUDGET ADOPTED

ELECT - GENERAL REVENUE $ 315,401 $ 319,384 $ 348,194 $ 347,943 $ 307,000

ELECT - CHARGES FOR SERVICE $ 22,246,613 $ 23,176,319 $ 25,335,304 $ 23,572,443 $ 23,691,484

TOTAL ELECTRIC FUND $ 22,562,014 $ 23,495,703 $ 25,683,497 $ 23,920,386 $ 23,998,484

CAPITAL PROJECTS FUNDS

Transfers

¾ Transfers from each fund’s Operating account to its respective Capital Improvement Project

account to cover budgeted CIP projects.

WĂŐĞ ϯϬ