Page 60 - Annual Report 2552

P. 60

PDMO PUBLIC DEBT

MANAGEMENT

OFFICE

Government Bonds Issuance Results

- Primary Market: Benchmark Bonds with maturities of 5 and 10 years has Bid Coverage Ratio

(BCR) at 2.0 and 1.6 percent respectively which is similar to the previous year despite an increase in

auction size.

- Secondary Market: 5 and 10 years benchmark bonds ranked first and second in highest trading

volume. The Turnover Ratio is at 2.4 for 5 years Benchmark bonds and 2.2 for 10 years Benchmark

Bonds indicating that there is decent liquidity. Moreover, the proportion of trading to total outstanding

amount for 5 and 10 years Benchmark bonds is at 20.3 and 16.1 respectively.

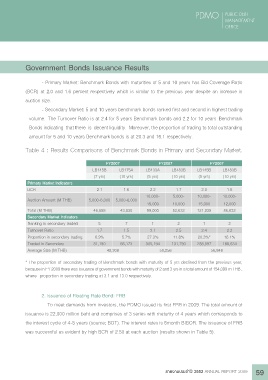

Table 4 : Results Comparisons of Benchmark Bonds in Primary and Secondary Market.

FY2007 FY2007 FY2007

LB145B LB175A LB133A LB183B LB145B LB183B

(7 yrs) (10 yrs) (5 yrs) (10 yrs) (5 yrs) (10 yrs)

Primary Market Indicators

BCR 2.1 1.6 2.2 1.7 2.0 1.6

10,000- 5,000- 10,000- 10,000-

Auction Amount (M THB) 5,000-6,000 5,000-6,000

15,000 10,000 15,000 12,000

Total (M THB) 46,655 43,830 99,000 52,632 121,035 86,632

Secondary Market Indicators

Ranking in secondary traded 5 7 1 2 1 2

Turnover Ratio 1.7 1.5 3.1 2.5 2.4 2.2

Proportion in secondary trading 6.9% 5.7% 27.3% 11.8% 20.3%* 16.1%

Traded in Secondary 81,190 66,173 305,194 131,790 288,897 188,634

Average Size (M THB) 42,308 50,256 56,848

* The proportion of secondary trading of Benchmark bonds with maturity of 5 yrs declined from the previous year,

because in FY 2009 there was issuance of government bonds with maturity of 2 and 3 yrs in a total amount of 154,099 m THB ,

where proportion in secondary trading at 3.1 and 13.0 respectively.

2. Issuance of Floating Rate Bond: FRB

To meet demands from investors, the PDMO issued its first FRB in 2009. The total amount of

issuance is 22,000 million baht and comprises of 3 series with maturity of 4 years which corresponds to

the interest cycle of 4-5 years (source; BOT). The interest rates is 6month BIBOR. The issuance of FRB

was successful as evident by high BCR of 2.50 at each auction (results shown in Table 5).

รายงานประจำาปี 2552 ANNUAL REPORT 2009 59