Page 79 - BWA Annual Report 2019

P. 79

WESTERN AUSTRALIAN

BASKETBALL FEDERATION INC.

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2019

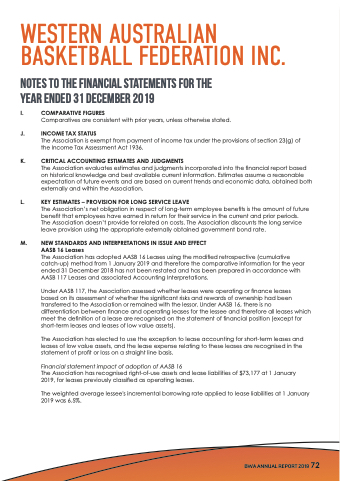

I. COMPARATIVE FIGURES

Comparatives are consistent with prior years, unless otherwise stated.

J. INCOME TAX STATUS

The Association is exempt from payment of income tax under the provisions of section 23(g) of the Income Tax Assessment Act 1936.

K. CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The Association evaluates estimates and judgments incorporated into the financial report based on historical knowledge and best available current information. Estimates assume a reasonable expectation of future events and are based on current trends and economic data, obtained both externally and within the Association.

L. KEY ESTIMATES – PROVISION FOR LONG SERVICE LEAVE

The Association’s net obligation in respect of long-term employee benefits is the amount of future benefit that employees have earned in return for their service in the current and prior periods. The Association doesn’t provide for related on costs. The Association discounts the long service leave provision using the appropriate externally obtained government bond rate.

M. NEW STANDARDS AND INTERPRETATIONS IN ISSUE AND EFFECT AASB 16 Leases

The Association has adopted AASB 16 Leases using the modified retrospective (cumulative catch-up) method from 1 January 2019 and therefore the comparative information for the year ended 31 December 2018 has not been restated and has been prepared in accordance with AASB 117 Leases and associated Accounting Interpretations.

Under AASB 117, the Association assessed whether leases were operating or finance leases

based on its assessment of whether the significant risks and rewards of ownership had been transferred to the Association or remained with the lessor. Under AASB 16, there is no differentiation between finance and operating leases for the lessee and therefore all leases which meet the definition of a lease are recognised on the statement of financial position (except for short-term leases and leases of low value assets).

The Association has elected to use the exception to lease accounting for short-term leases and leases of low value assets, and the lease expense relating to these leases are recognised in the statement of profit or loss on a straight line basis.

Financial statement impact of adoption of AASB 16

The Association has recognised right-of-use assets and lease liabilities of $73,177 at 1 January 2019, for leases previously classified as operating leases.

The weighted average lessee's incremental borrowing rate applied to lease liabilities at 1 January 2019 was 6.5%.

BWA ANNUAL REPORT 2019 72