Page 80 - BWA Annual Report 2019

P. 80

WESTERN AUSTRALIAN BASKETBALL FEDERATION INC.

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 31 DECEMBER 2019

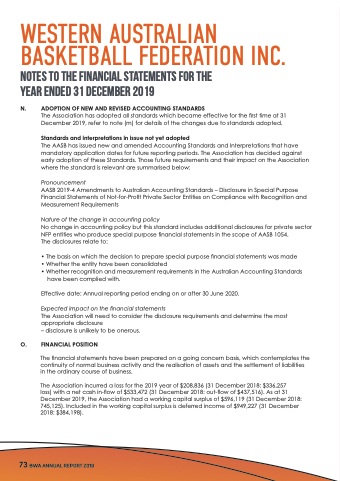

N. ADOPTION OF NEW AND REVISED ACCOUNTING STANDARDS

The Association has adopted all standards which became effective for the first time at 31 December 2019, refer to note (m) for details of the changes due to standards adopted.

Standards and interpretations in issue not yet adopted

The AASB has issued new and amended Accounting Standards and Interpretations that have mandatory application dates for future reporting periods. The Association has decided against early adoption of these Standards. Those future requirements and their impact on the Association where the standard is relevant are summarised below:

Pronouncement

AASB 2019-4 Amendments to Australian Accounting Standards – Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements

Nature of the change in accounting policy

No change in accounting policy but this standard includes additional disclosures for private sector NFP entities who produce special purpose financial statements in the scope of AASB 1054.

The disclosures relate to:

• The basis on which the decision to prepare special purpose financial statements was made • Whether the entity have been consolidated

• Whether recognition and measurement requirements in the Australian Accounting Standards

have been complied with.

Effective date: Annual reporting period ending on or after 30 June 2020.

Expected impact on the financial statements

The Association will need to consider the disclosure requirements and determine the most appropriate disclosure

– disclosure is unlikely to be onerous.

O. FINANCIAL POSITION

The financial statements have been prepared on a going concern basis, which contemplates the continuity of normal business activity and the realisation of assets and the settlement of liabilities in the ordinary course of business.

The Association incurred a loss for the 2019 year of $208,836 (31 December 2018: $336,257

loss) with a net cash in-flow of $533,472 (31 December 2018: out-flow of $437,516). As at 31 December 2019, the Association had a working capital surplus of $596,119 (31 December 2018: 745,125). Included in the working capital surplus is deferred income of $949,227 (31 December 2018: $384,198).

73 BWA ANNUAL REPORT 2019