Page 5 - McLarty 2017-2018 Benefits Booklet

P. 5

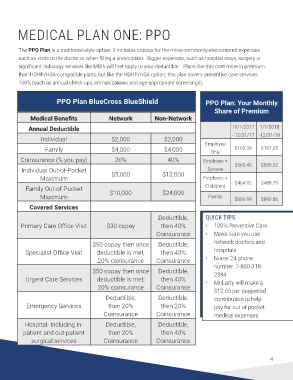

MEDICAL PLAN ONE: PPO

The PPO Plan is a traditional-style option. It includes copays for the more commonly-encountered expenses

such as visits to the doctor or when filling a prescription. Bigger expenses, such as hospital stays, surgery or

significant radiology services like MRIs will first apply to your deductible. Plans like this cost more in premium

than HDHP/HSA-compatible plans, but like the HDHP/HSA option, this plan covers preventive care services

100% (such as annual check-ups, immunizations and age-appropriate screenings).

PPO Plan BlueCross BlueShield PPO Plan: Your Monthly

Share of Premium

Medical Benefits Network Non-Network

Annual Deductible 10/1/2017 1/1/2018

- 12/31/17 -12/31/18

Individual $2,000 $2,000

Employee

Family $4,000 $4,000 Only $163.38 $187.25

Coinsurance (% you pay) 20% 40% Employee +

Individual Out-of-Pocket Spouse $565.45 $589.32

Maximum $5,000 $12,000 Employee +

Family Out-of-Pocket Child(ren) $464.92 $488.79

Maximum $10,000 $24,000 Family $866.99 $890.86

Covered Services

Deductible, QUICK TIPS

Primary Care Office Visit $30 copay then 40% • 100% Preventive Care

Coinsurance • Make sure you use

$50 copay then once Deductible, network doctors and

Specialist Office Visit deductible is met, then 40% hospitals

20% coinsurance Coinsurance • Nurse 24 phone

number: 1-800-318-

$50 copay then once Deductible, 2384

Urgent Care Services deductible is met, then 40% • McLarty will make a

20% coinsurance Coinsurance $12.50 per payperiod

Deductible, Deductible, contribution to help

Emergency Services then 20% then 20% pay for out of pocket

Coinsurance Coinsurance medical expenses

Hospital- including in- Deductible, Deductible,

patient and out-patient then 20% then 40%

surgical services Coinsurance Coinsurance

4