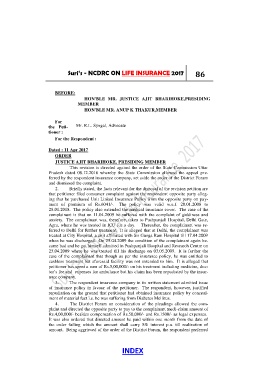

Page 86 - Suri’s - NCDRC ON LIFE INSURANCE 2017 V1.3

P. 86

Suri’s - NCDRC ON LIFE INSURANCE 2017 86

BEFORE:

HON'BLE MR. JUSTICE AJIT BHARIHOKE,PRESIDING

MEMBER

HON'BLE MR. ANUP K THAKUR,MEMBER

For

the Peti- Mr. R.L. Syngal, Advocate

tioner :

For the Respondent :

Dated : 11 Apr 2017

ORDER

JUSTICE AJIT BHARIHOKE, PRESIDING MEMBER

This revision is directed against the order of the State Commission Uttar

Pradesh dated 08.12.2016 whereby the State Commission allowed the appeal pre-

ferred by the respondent insurance company, set aside the order of the District Forum

and dismissed the complaint.

2. Briefly stated, the facts relevant for the disposal of the revision petition are

that petitioner filed consumer complaint against the respondent opposite party alleg-

ing that he purchased Unit Linked Insurance Policy from the opposite party on pay-

ment of premium of Rs.6041/-. The policy was valid w.e.f. 28.01.2008 to

28.01.2018. The policy also extended the medical insurance cover. The case of the

complainant is that on 11.04.2009 he suffered with the complaint of giddiness and

anxiety. The complainant was, therefore, taken to Pushpanjali Hospital, Delhi Gate,

Agra, where he was treated in ICU for a day. Thereafter, the complainant was re-

ferred to Delhi for further treatment. It is alleged that at Delhi, the complainant was

treated at City Hospital, a unit affiliated with Sir Ganga Ram Hospital till 17.04.2009

when he was discharged. On 25.04.2009 the condition of the complainant again be-

came bad and he got himself admitted in Pushpanjali Hospital and Research Centre on

25.04.2009 where he was treated till his discharge on 03.05.2009. It is further the

case of the complainant that though as per the insurance policy, he was entitled to

cashless treatment but aforesaid facility was not extended to him. It is alleged that

petitioner has spent a sum of Rs.5,00,000/- on his treatment including medicine, doc-

tor‘s fee and expenses for ambulance but his claim has been repudiated by the insur-

ance company.

3. The respondent insurance company in its written statement admitted issue

of insurance policy in favour of the petitioner. The respondent, however, justified

repudiation on the ground that petitioner had obtained insurance policy by conceal-

ment of material fact i.e. he was suffering from Diabetes Mellitus.

4. The District Forum on consideration of the pleadings allowed the com-

plaint and directed the opposite party to pay to the complainant medi-claim amount of

Rs.4,00,000/- besides compensation of Rs.50,000/- and Rs.1500/- as legal expenses.

It was also ordered that directed amount be paid within one month from the date of

the order failing which the amount shall carry 8% interest p.a. till realization of

amount. Being aggrieved of the order of the District Forum, the respondent preferred

INDEX