Page 210 - Corporate Finance PDF Final new link

P. 210

NPP

210 Corporate Finance BRILLIANT’S

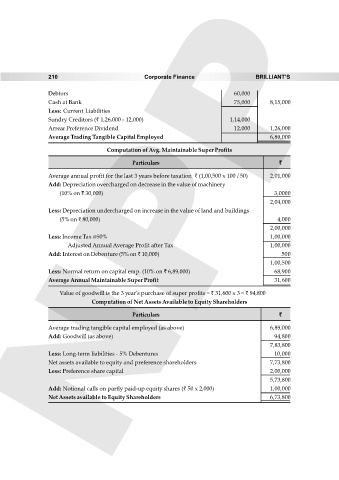

Debtors 60,000

Cash at Bank 75,000 8,15,000

Less: Current Liabilities

Sundry Creditors (` 1,26,000 - 12,000) 1,14,000

Arrear Preference Dividend 12,000 1,26,000

Average Trading Tangible Capital Employed 6,89,000

Computation of Avg. Maintainable Super Profits

Particulars `

Average annual profit for the last 3 years before taxation ` (1,00,500 x 100 / 50) 2,01,000

Add: Depreciation overcharged on decrease in the value of machinery

(10% on ` 30,000) 3,0000

2,04,000

Less: Depreciation undercharged on increase in the value of land and buildings

(5% on ` 80,000) 4,000

2,00,000

Less: Income Tax @50% 1,00,000

Adjusted Annual Average Profit after Tax 1,00,000

Add: Interest on Debenture (5% on ` 10,000) 500

1,00,500

Less: Normal return on capital emp. (10% on ` 6,89,000) 68,900

Average Annual Maintainable Super Profit 31,600

Value of goodwill is the 3 year's purchase of super profits = ` 31,600 x 3 = ` 94,800

Computation of Net Assets Available to Equity Shareholders

Particulars `

Average trading tangible capital employed (as above) 6,89,000

Add: Goodwill (as above) 94,800

7,83,800

Less: Long-term liabilities - 5% Debentures 10,000

Net assets available to equity and preference shareholders 7,73,800

Less: Preference share capital 2,00,000

5,73,800

Add: Notional calls on partly paid-up equity shares (` 50 x 2,000) 1,00,000

Net Assets available to Equity Shareholders 6,73,800