Page 36 - business%20kit%20print%20-%20V.6%2005.11.18

P. 36

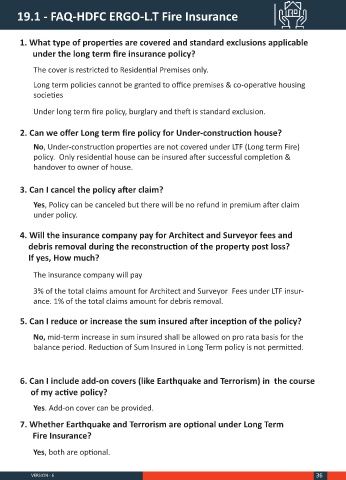

19.1 - FAQ-HDFC ERGO-L.T Fire Insurance

1. What type of properties are covered and standard exclusions applicable

under the long term fire insurance policy?

The cover is restricted to Residential Premises only.

Long term policies cannot be granted to office premises & co-operative housing

societies

Under long term fire policy, burglary and theft is standard exclusion.

2. Can we offer Long term fire policy for Under-construction house?

No, Under-construction properties are not covered under LTF (Long term Fire)

policy. Only residential house can be insured after successful completion &

handover to owner of house.

3. Can I cancel the policy after claim?

Yes, Policy can be canceled but there will be no refund in premium after claim

under policy.

4. Will the insurance company pay for Architect and Surveyor fees and

debris removal during the reconstruction of the property post loss?

If yes, How much?

The insurance company will pay

3% of the total claims amount for Architect and Surveyor Fees under LTF insur-

ance. 1% of the total claims amount for debris removal.

5. Can I reduce or increase the sum insured after inception of the policy?

No, mid-term increase in sum insured shall be allowed on pro rata basis for the

balance period. Reduction of Sum Insured in Long Term policy is not permitted.

6. Can I include add-on covers (like Earthquake and Terrorism) in the course

of my active policy?

Yes. Add-on cover can be provided.

7. Whether Earthquake and Terrorism are optional under Long Term

Fire Insurance?

Yes, both are optional.

VERSION - 6 36