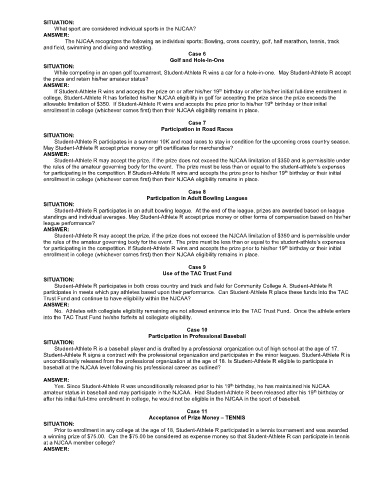

Page 280 - 2019-20 NJCAA Handbook - May, 2020

P. 280

SITUATION:

What sport are considered individual sports in the NJCAA?

ANSWER:

The NJCAA recognizes the following as individual sports: Bowling, cross country, golf, half marathon, tennis, track

and field, swimming and diving and wrestling.

Case 6

Golf and Hole-In-One

SITUATION:

While competing in an open golf tournament, Student-Athlete R wins a car for a hole-in-one. May Student-Athlete R accept

the prize and retain his/her amateur status?

ANSWER:

th

If Student-Athlete R wins and accepts the prize on or after his/her 19 birthday or after his/her initial full-time enrollment in

college, Student-Athlete R has forfeited his/her NJCAA eligibility in golf for accepting the prize since the prize exceeds the

allowable limitation of $350. If Student-Athlete R wins and accepts the prize prior to his/her 19 birthday or their initial

th

enrollment in college (whichever comes first) then their NJCAA eligibility remains in place.

Case 7

Participation in Road Races

SITUATION:

Student-Athlete R participates in a summer 10K and road races to stay in condition for the upcoming cross country season.

May Student-Athlete R accept prize money or gift certificates for merchandise?

ANSWER:

Student-Athlete R may accept the prize, if the prize does not exceed the NJCAA limitation of $350 and is permissible under

the rules of the amateur governing body for the event. The prize must be less than or equal to the student-athlete’s expenses

for participating in the competition. If Student-Athlete R wins and accepts the prize prior to his/her 19 birthday or their initial

th

enrollment in college (whichever comes first) then their NJCAA eligibility remains in place.

Case 8

Participation in Adult Bowling Leagues

SITUATION:

Student-Athlete R participates in an adult bowling league. At the end of the league, prizes are awarded based on league

standings and individual averages. May Student-Athlete R accept prize money or other forms of compensation based on his/her

league performance?

ANSWER:

Student-Athlete R may accept the prize, if the prize does not exceed the NJCAA limitation of $350 and is permissible under

the rules of the amateur governing body for the event. The prize must be less than or equal to the student-athlete’s expenses

for participating in the competition. If Student-Athlete R wins and accepts the prize prior to his/her 19 birthday or their initial

th

enrollment in college (whichever comes first) then their NJCAA eligibility remains in place.

Case 9

Use of the TAC Trust Fund

SITUATION:

Student-Athlete R participates in both cross country and track and field for Community College A. Student-Athlete R

participates in meets which pay athletes based upon their performance. Can Student-Athlete R place these funds into the TAC

Trust Fund and continue to have eligibility within the NJCAA?

ANSWER:

No. Athletes with collegiate eligibility remaining are not allowed entrance into the TAC Trust Fund. Once the athlete enters

into the TAC Trust Fund he/she forfeits all collegiate eligibility.

Case 10

Participation in Professional Baseball

SITUATION:

Student-Athlete R is a baseball player and is drafted by a professional organization out of high school at the age of 17.

Student-Athlete R signs a contract with the professional organization and participates in the minor leagues. Student-Athlete R is

unconditionally released from the professional organization at the age of 18. Is Student-Athlete R eligible to participate in

baseball at the NJCAA level following his professional career as outlined?

ANSWER:

Yes. Since Student-Athlete R was unconditionally released prior to his 19 birthday, he has maintained his NJCAA

th

th

amateur status in baseball and may participate in the NJCAA. Had Student-Athlete R been released after his 19 birthday or

after his initial full-time enrollment in college, he would not be eligible in the NJCAA in the sport of baseball.

Case 11

Acceptance of Prize Money – TENNIS

SITUATION:

Prior to enrollment in any college at the age of 18, Student-Athlete R participated in a tennis tournament and was awarded

a winning prize of $75.00. Can the $75.00 be considered as expense money so that Student-Athlete R can participate in tennis

at a NJCAA member college?

ANSWER: