Page 27 - John Hundley 2013

P. 27

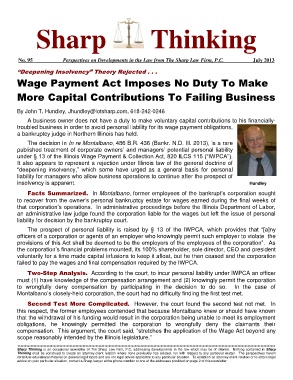

Sharp Thinking

No. 95 Perspectives on Developments in the Law from The Sharp Law Firm, P.C. July 2013

“Deepening Insolvency” Theory Rejected . . .

Wage Payment Act Imposes No Duty To Make

More Capital Contributions To Failing Business

By John T. Hundley, Jhundley@lotsharp.com, 618-242-0246

A business owner does not have a duty to make voluntary capital contributions to his financially-

troubled business in order to avoid personal liability for its wage payment obligations,

a bankruptcy judge in Northern Illinois has held.

The decision in In re Montalbano, 486 B.R. 436 (Bankr. N.D. Ill. 2013), is a rare

published treatment of corporate owners’ and managers’ potential personal liability

under § 13 of the Illinois Wage Payment & Collection Act, 820 ILCS 115 (“IWPCA”).

It also appears to represent a rejection under Illinois law of the general doctrine of

“deepening insolvency,” which some have urged as a general basis for personal

liability for managers who allow business operations to continue after the prospect of

insolvency is apparent. Hundley

Facts Summarized. In Montalbano, former employees of the bankrupt’s corporation sought

to recover from the owner’s personal bankruptcy estate for wages earned during the final weeks of

that corporation’s operations. In administrative proceedings before the Illinois Department of Labor,

an administrative law judge found the corporation liable for the wages but left the issue of personal

liability for decision by the bankruptcy court.

The prospect of personal liability is raised by § 13 of the IWPCA, which provides that “[a]ny

officers of a corporation or agents of an employer who knowingly permit such employer to violate the

provisions of this Act shall be deemed to be the employers of the employees of the corporation”. As

the corporation’s financial problems mounted, its 100% shareholder, sole director, CEO and president

voluntarily for a time made capital infusions to keep it afloat, but he then ceased and the corporation

failed to pay the wages and final compensation required by the IWPCA.

Two-Step Analysis. According to the court, to incur personal liability under IWPCA an officer

must (1) have knowledge of the compensation arrangement and (2) knowingly permit the corporation

to wrongfully deny compensation by participating in the decision to do so. In the case of

Montalbano’s closely-held corporation, the court had no difficulty finding the first test met.

Second Test More Complicated. However, the court found the second test not met. In

this respect, the former employees contended that because Montalbano knew or should have known

that the withdrawal of his funding would result in the corporation being unable to meet its employment

obligations, he knowingly permitted the corporation to wrongfully deny the claimants their

compensation. This argument, the court said, “stretches the application of the Wage Act beyond any

scope reasonably intended by the Illinois legislature.”

●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●●

Sharp Thinking is an occasional newsletter of The Sharp Law Firm, P.C. addressing developments in the law which may be of interest. Nothing contained in Sharp

Thinking shall be construed to create an attorney-client relation where none previously has existed, nor with respect to any particular matter. The perspectives herein

constitute educational material on general legal topics and are not legal advice applicable to any particular situation. To establish an attorney-client relation or to obtain legal

advice on your particular situation, contact a Sharp lawyer at the phone number or one of the addresses provided on page 2 of this newsletter.