Page 7 - AR_NorthSuburbs

P. 7

Role of the Assessor’s Office

The Cook County Assessor’s Office (CCAO) has three primary roles within the Cook County

property tax system.

1. Valuing Property

For nearly 1.9 million parcels of residential and commercial

properties, the primary duty of the Cook County Assessor’s Fair Cash Value (35 ILCS

Office is to fairly and uniformly determine this: 200/1-50): “The amount for

which a property can be sold

“What is this property worth?” in the due course of business

and trade, not under duress,

Per the Illinois Property Tax Code, each property in Cook between a willing buyer and a

County is reassessed every three years (35 ILCS 200/9-220) willing seller.”

according to its Fair Cash Value.

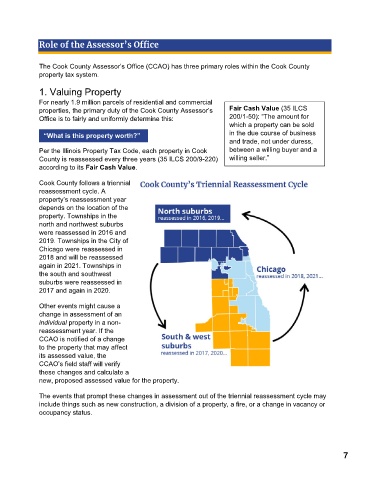

Cook County follows a triennial

reassessment cycle. A

property’s reassessment year

depends on the location of the

property. Townships in the

north and northwest suburbs

were reassessed in 2016 and

2019. Townships in the City of

Chicago were reassessed in

2018 and will be reassessed

again in 2021. Townships in

the south and southwest

suburbs were reassessed in

2017 and again in 2020.

Other events might cause a

change in assessment of an

individual property in a non-

reassessment year. If the

CCAO is notified of a change

to the property that may affect

its assessed value, the

CCAO’s field staff will verify

these changes and calculate a

new, proposed assessed value for the property.

The events that prompt these changes in assessment out of the triennial reassessment cycle may

include things such as new construction, a division of a property, a fire, or a change in vacancy or

occupancy status.

7