Page 274 - pwc-lease-accounting-guide_Neat

P. 274

Effective date and transition

10.1 Chapter overview

The leases standard is applicable for most public business entities starting in 2019. Adopting the leases

standard could be a significant undertaking. Some reporting entities will need a significant amount of

lead time to make the necessary changes to their systems and processes. The standard includes some

practical expedients to ease the burden of transition.

This chapter discusses the effective date and transition guidance. See LG 9 for details regarding

transition related disclosures.

10.2 Effective date

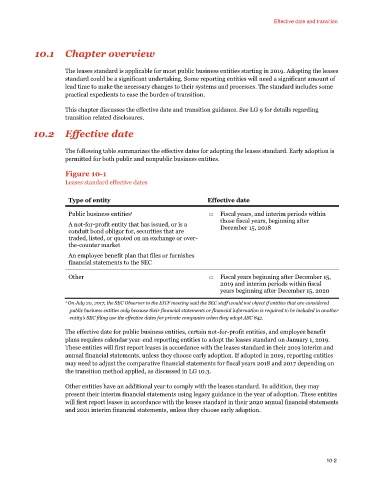

The following table summarizes the effective dates for adopting the leases standard. Early adoption is

permitted for both public and nonpublic business entities.

Figure 10-1

Leases standard effective dates

Type of entity Effective date

Public business entities □ Fiscal years, and interim periods within

1

those fiscal years, beginning after

A not-for-profit entity that has issued, or is a December 15, 2018

conduit bond obligor for, securities that are

traded, listed, or quoted on an exchange or over-

the-counter market

An employee benefit plan that files or furnishes

financial statements to the SEC

Other □ Fiscal years beginning after December 15,

2019 and interim periods within fiscal

years beginning after December 15, 2020

1 On July 20, 2017, the SEC Observer to the EITF meeting said the SEC staff would not object if entities that are considered

public business entities only because their financial statements or financial information is required to be included in another

entity’s SEC filing use the effective dates for private companies when they adopt ASC 842.

The effective date for public business entities, certain not-for-profit entities, and employee benefit

plans requires calendar year-end reporting entities to adopt the leases standard on January 1, 2019.

These entities will first report leases in accordance with the leases standard in their 2019 interim and

annual financial statements, unless they choose early adoption. If adopted in 2019, reporting entities

may need to adjust the comparative financial statements for fiscal years 2018 and 2017 depending on

the transition method applied, as discussed in LG 10.3.

Other entities have an additional year to comply with the leases standard. In addition, they may

present their interim financial statements using legacy guidance in the year of adoption. These entities

will first report leases in accordance with the leases standard in their 2020 annual financial statements

and 2021 interim financial statements, unless they choose early adoption.

10-2