Page 3 - Petrodollar recycling - Wikipedia_Neat

P. 3

accumulated debts to be unpayably large, concluding that it was a form of neocolonialism from

which debt relief was the only escape. [18]

2005–2014 surge

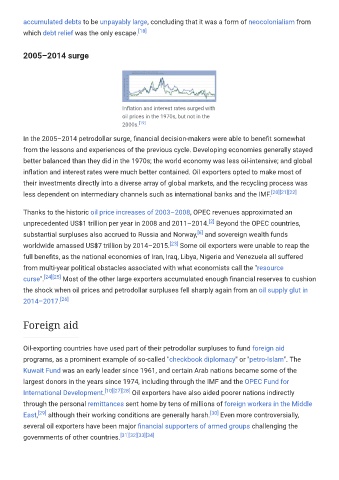

Inflation and interest rates surged with

oil prices in the 1970s, but not in the

2000s. [19]

In the 2005–2014 petrodollar surge, financial decision-makers were able to benefit somewhat

from the lessons and experiences of the previous cycle. Developing economies generally stayed

better balanced than they did in the 1970s; the world economy was less oil-intensive; and global

inflation and interest rates were much better contained. Oil exporters opted to make most of

their investments directly into a diverse array of global markets, and the recycling process was

less dependent on intermediary channels such as international banks and the IMF. [20][21][22]

Thanks to the historic oil price increases of 2003–2008, OPEC revenues approximated an

[2]

unprecedented US$1 trillion per year in 2008 and 2011–2014. Beyond the OPEC countries,

[6]

substantial surpluses also accrued to Russia and Norway, and sovereign wealth funds

worldwide amassed US$7 trillion by 2014–2015. [23] Some oil exporters were unable to reap the

full benefits, as the national economies of Iran, Iraq, Libya, Nigeria and Venezuela all suffered

from multi-year political obstacles associated with what economists call the "resource

curse". [24][25] Most of the other large exporters accumulated enough financial reserves to cushion

the shock when oil prices and petrodollar surpluses fell sharply again from an oil supply glut in

2014–2017. [26]

Foreign aid

Oil-exporting countries have used part of their petrodollar surpluses to fund foreign aid

programs, as a prominent example of so-called "checkbook diplomacy" or "petro-Islam". The

Kuwait Fund was an early leader since 1961, and certain Arab nations became some of the

largest donors in the years since 1974, including through the IMF and the OPEC Fund for

International Development. [10][27][28] Oil exporters have also aided poorer nations indirectly

through the personal remittances sent home by tens of millions of foreign workers in the Middle

East, [29] although their working conditions are generally harsh. [30] Even more controversially,

several oil exporters have been major financial supporters of armed groups challenging the

governments of other countries. [31][32][33][34]