Page 219 - Brook-Hollow Due Diligence Package

P. 219

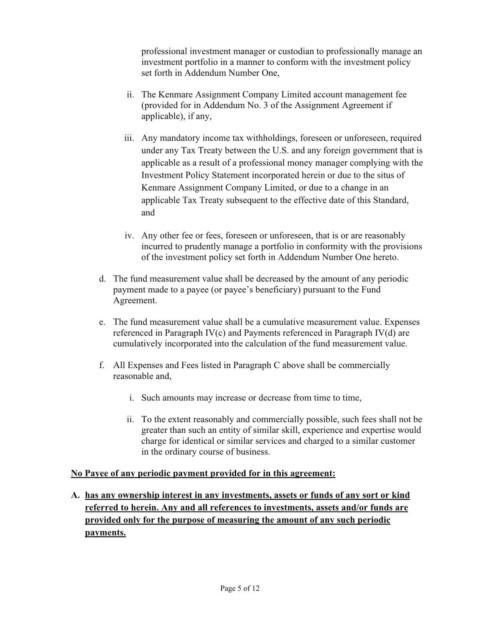

Attachment Number One professional investment manager or custodian to professionally manage an

investment portfolio in a manner to conform with the investment policy

Kenmare Assignment Company Limited set forth in Addendum Number One,

Investment Performance Measurement Standard 2020XX0XXX

Effective September 1, 2020 ii. The Kenmare Assignment Company Limited account management fee

(provided for in Addendum No. 3 of the Assignment Agreement if

I. This investment performance measurement standard is an objective means for measuring applicable), if any,

the investment performance of a professionally managed investment portfolio according

to the parameters set forth herein. The specific parameters are contained in and set forth iii. Any mandatory income tax withholdings, foreseen or unforeseen, required

with specificity in the investment policy, which is appended hereto as Addendum under any Tax Treaty between the U.S. and any foreign government that is

Number One. applicable as a result of a professional money manager complying with the

Investment Policy Statement incorporated herein or due to the situs of

II. The “beginning fund measurement value” is the dollar amount set forth in section 2.2 of

the Fund Agreement to which this Standard is a part, and in the event the future payment Kenmare Assignment Company Limited, or due to a change in an

obligation(s) referred to in Section 2.1 are assigned to Kenmare Assignment Company applicable Tax Treaty subsequent to the effective date of this Standard,

Limited, then such amount shall be, for beginning fund measurement purposes, adjusted and

to reflect any and all charges, expenses or commissions provided for explicitly in

Addendum No. 3 of the Assignment Agreement (i.e., the “applicable adjustment amount” iv. Any other fee or fees, foreseen or unforeseen, that is or are reasonably

therein referenced) effectuating such an assignment. incurred to prudently manage a portfolio in conformity with the provisions

of the investment policy set forth in Addendum Number One hereto.

III. The “fund measurement value” is that amount that a professionally managed investment

fund comprised of the assets allowed for in and managed in conformity with the d. The fund measurement value shall be decreased by the amount of any periodic

investment policy, attached hereto as Addendum Number One, would be valued at on any payment made to a payee (or payee’s beneficiary) pursuant to the Fund

specific date. The amount of each periodic payment provided for in section 2.1 of the Agreement.

Fund Agreement is based upon the fund measurement value.

e. The fund measurement value shall be a cumulative measurement value. Expenses

IV. The “fund measurement value” shall be calculated as follows: referenced in Paragraph IV(c) and Payments referenced in Paragraph IV(d) are

cumulatively incorporated into the calculation of the fund measurement value.

a. The initial fund measurement value shall equal the “beginning fund measurement

value.” f. All Expenses and Fees listed in Paragraph C above shall be commercially

reasonable and,

b. The fund measurement value shall be increased and decreased (valued at close of

market price on the date of measurement for publicly traded investments or i. Such amounts may increase or decrease from time to time,

investments for which publicly published prices exist) periodically pursuant to

performance of an individual investment vehicle or pool of investment vehicles ii. To the extent reasonably and commercially possible, such fees shall not be

that would comprise an account invested pursuant to the investment guidelines set greater than such an entity of similar skill, experience and expertise would

forth in Addendum Number One hereto (the Investment Policy) and additionally charge for identical or similar services and charged to a similar customer

as if such investment or pool of investments was invested by and professionally in the ordinary course of business.

managed by the investment manager referenced in the investment policy

contained in Addendum Number One or an investment manager with substantially No Payee of any periodic payment provided for in this agreement:

similar skills, experience and expertise.

A. has any ownership interest in any investments, assets or funds of any sort or kind

c. The fund measurement value shall be decreased by the following expenses, which referred to herein. Any and all references to investments, assets and/or funds are

shall be calculated as if they were deducted from the fund measurement value on provided only for the purpose of measuring the amount of any such periodic

a monthly basis:

payments.

i. Any custodian fee(s), investment management or investment manager

fees, and/or direct trading expenses that would be incurred by a

Page 4 of 12 Page 5 of 12