Page 224 - Washington Nonprofit Handbook 2018 Edition

P. 224

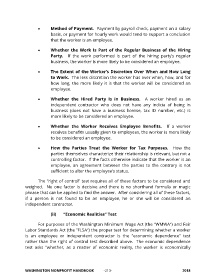

• Method of Payment. Payment by payroll check, payment on a salary

basis, or payment for hourly work would tend to support a conclusion

that the worker is an employee.

• Whether the Work Is Part of the Regular Business of the Hiring

Party. If the work performed is part of the hiring party’s regular

business, the worker is more likely to be considered an employee.

• The Extent of the Worker’s Discretion Over When and How Long

to Work. The less discretion the worker has over when, how, and for

how long, the more likely it is that the worker will be considered an

employee.

• Whether the Hired Party Is in Business. A worker hired as an

independent contractor who does not have any indicia of being in

business (does not have a business license, tax ID number, etc.) is

more likely to be considered an employee.

• Whether the Worker Receives Employee Benefits. If a worker

receives benefits usually given to employees, the worker is more likely

to be considered an employee.

• How the Parties Treat the Worker for Tax Purposes. How the

parties themselves characterize their relationship is relevant, but not a

controlling factor. If the facts otherwise indicate that the worker is an

employee, an agreement between the parties to the contrary is not

sufficient to alter the employee’s status.

The “right of control” test requires all of these factors to be considered and

weighed. No one factor is decisive and there is no shorthand formula or magic

phrase that can be applied to find the answer. After considering all of these factors,

if a person is not found to be an employee, he or she will be considered an

independent contractor.

(ii) “Economic Realities” Test

For purposes of the Washington Minimum Wage Act (the “WMWA”) and Fair

Labor Standards Act (the “FLSA”) the proper test for determining whether a worker

is an employee or independent contractor is the “economic dependence” test

rather than the right of control test described above. The economic dependence

test asks “whether, as a matter of economic reality, the worker is economically

WASHINGTON NONPROFIT HANDBOOK -213- 2018