Page 11 - DURHAM CITIZEN MAY 24TH 2021_Black

P. 11

DurhamCitizen.ca May 24, 2021 11

Do you know someone retiring in 2021 and can use the advice

of a 32 year experienced retirement specialist? MONEY

Go to: www.retire-rite.ca and Like/Share @: www.facebook.com/retireritelifestylesolutions

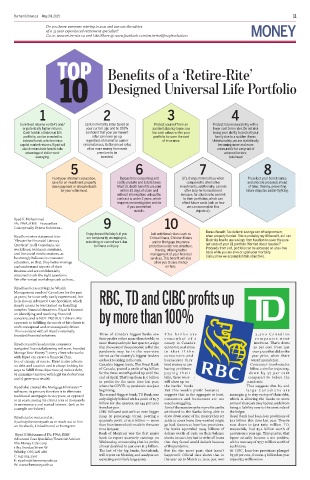

TOP Benefits of a ‘Retire-Rite’

10 Designed Universal Life Portfolio

1 2 3 4

Earn fixed returns via GIA’s and/ Lock in mortality rates based on Protect yourself from an Protect future insurability with a

or potentially higher returns. your current age and be 100% accidental policy lapse; use lower cost term rider. Do not risk

Cash held in a Universal Life confident that your permanent the cash values within your losing your ability to protect your

portfolio, can be invested in rates can never go up, portfolio to cover the cost family due to a sudden illness.

indexed funds, which mimics regardless of market or carrier of insurance. Unfortunately, we are statistically

capital market returns. Riyad will circumstances. Better priced rates becoming more and more

also demonstrate how to take allow more money from each uninsurable for a myriad of

advantage of dollar-cost- premium to be external factors;

averaging. invested. take heed

5 9 7 8

Fund your children’s education, Bypass time consuming and Ul’s charge minimal fees when Preselect your beneficiaries

save for an investment property costly probate and Estate taxes. compared to alternative and allocate proceeds ahead

down payment or allocate funds Most UL death benefits are paid investments, additionally, carriers of time; thereby, preventing

for your retirement. within 30 days of claim and offer long-term investment future disputes and in-fighting.

without interruption, unless the bonuses, for clients who commit

contract is under 2 years, which to their portfolios, which can

requires an investigation and/or offset future costs (ask us how

if you committed we can accomplish this

suicide. objective).

Ryad K Mohammed

FA; PWA; RMS – Focused on 9 10

Conceptually Driven Solutions…

Bonus Benefit: Tax deferral savings can offset premium,

Enjoy deposit holiday’s, if you Add additional riders such as

Riyad’s mission statement is to are temporarily unemployed, Critical Illness, Children Riders when properly funded. This is probably my #1 benefit, as I can

‘Elevate the Financial Literacy relocating or cannot work due and or Mortgage Insurance illustrate how to use savings from taxation to cover the pure

Quotient’ in all Canadians, via to illness or injury. protection under one structure, net costs of your UL portfolio. Worried about taxation?

workshops, webinars, seminars, thereby, offering better Proceeds from a UL portfolio can be accessed on a tax-free

and live social media sessions, as management of your financial basis while you are alive or upon your mortality

he strongly believes in consumer services. This benefit will also (ask us how we accomplish this objective).

education, so that, they better manage allow you to save money

and understand aspects of their on fees.

finances and are confidentially

prepared to ask the right questions.

We offer virtual workshops; ask us how…

Riyad has been serving the Wealth

Management needs of Canadians for the past

32 years; he is not only vastly experienced, but RBC, TD and CIBC profits up

he is also an Advanced Case Specialist, which

simply means he was trained on handling

complex financial situations. Riyad is focused

approach to fulfilling the needs of his clients is by more than 100%

on identifying and resolving financial

concerns; and is NOT PRODUCT driven. His

100% conceptual and or strategically driven.

This is evident with all Riyad’s internally

Three of Canada's biggest banks saw T h e b a n k s a r e 2 , 5 0 0 C a n a d i a n

branded financial solutions.

their profits either more than double or s o m e w h a t o f a c o m p a n i e s w e n t

more than quadruple last quarter, a sign canary in Canada's insolvent. That's down

Riyad created Canada’s first consumer

that the worst of the economic toll of the economic coal mine 30 per cent from just

navigated financial planning software, branded

pandemic may be in the rear-view i n t h a t i f t h e over 3,500 that did so the

Manage Your Money™; every client who works

mirror as the country's biggest lenders consumers and year prior, when there

with Riyad can create a Financial Plan,

are back to raking in the cash. businesses they wasn't a pandemic.

free of charge; of course. Riyad is also adverse

on debt and taxation and is always looking for Canada's biggest bank, The Royal Bank lend money to are Consumer insolvencies

ways to fulfill three objectives; a) reduce debt, of Canada, posted a profit of $4 billion having problems follow a similar trajectory,

b) minimize taxation with legit tax deductions for the three-month period up until the p a y i n g t h e i r down by 37 per cent

and c) grow your wealth end of April. That's up from $1.5 billion bills, those woes compared to before the

in profits for the same time last year, will show up on pandemic.

Riyad also created the Mortgage Eliminator™ when the COVID-19 pandemic was just the banks' books. That suggests that by and

software; its primary function is to eliminate beginning. But this week's profit bonanza l a r g e C a n a d i a n s a r e

traditional mortgages in 12.5 years, as opposed The second-biggest bank, TD Bank, was suggests that in the aggregate at least, managin g to stay on top of their debt,

to 25 years, saving his clients tens of thousands only slightly behind with a profit of $3.7 consumers and businesses are not which is allowing the banks to move

in unnecessary and wasted interest. (ask us for billion for the quarter, up 144 per cent exactly struggling. some of that cash they had set aside from

a sample worksheet) from last year. Part of the massive spike in profits can be being a liability over to the asset side of

CIBC followed suit with an even bigger attributed to the banks being able to the ledger.

Riyad can be contacted at: jump in percentage terms, posting a draw down some of the money they set Royal Bank had loan-loss provisions of

riyadm@themoneycafe.ca or reach out to him quarterly profit of $1.6 billion — more aside to cover loans they worried might $2.1 billion this time last year. They're

on Facebook, LinkedIn and or Instagram. than four times what it made in the same go bad. Known as loan-loss provisions, now down to just $260 million. TD,

time last year. the banks squirreled away billions of meanwhile, had $3.2 billion worth of

Riyad K Mohammed FA; PWA; RMS Bank of Montreal was the first major dollars worth of cash on their balance provisions a year ago. This quarter, that

Advanced Case Specialist/Financial Advisor bank to report quarterly earnings on sheets in case they had to write off loans figure actually became a net positive,

The Money Café Corp Wednesday, announcing that its profits that they feared would default because with a recovery of $377 million worth of

1-813 Dundas Street W almost doubled to just over $1.3 billion. of the pandemic. such loans.

Whitby; ON; L1N 2N6 The last of the big banks, Scotiabank, But for the most part, that hasn't At CIBC, loan-loss provisions plunged

C: 647.554.2307 will report on Monday, and analysts are happened. Official data shows that in by 98 per cent, from $1.4 billion last year

E: riyadm@themoneycafe.ca expecting a similarly large jump. the year up to March 31, 2021, just over to just $32 million now.

W: www.themoneycafe.ca