Page 253 - ACCESS BANK ANNUAL REPORTS_eBook

P. 253

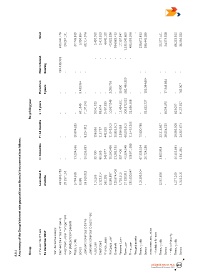

412,567,554 188,239,520 126,707,982 40,960,665 21,699,880 - 40,363,051 33,265,072 2,845,414,378 136,163,848 85,513,821 158,994,793 900,436,358 1,281,108,820 Total 953,944,176 20,257,131 37,743,819 9,050,894 68,114,076 3,450,060 3,410,923 4,642,100 43,622,936 184,889,415 17,137,947 1,239,240,650 499,593,596 - 258,672,815 188,441,589 29,977,451 54,079,368 88,203,365 36,

4,701,331 26,362,557 26,362,557

- - - - - - - - - - - Non-Interest bearing 692,138,393 - - - - - - - - - - - - - - - - - -

2,760,661 2,445,558 19,115 169,350,336 97,065,142 97,065,142

- - - - - - - - More than 5 years - - - 8,430,064 - - - - 3,059,705 - 63,800 583,495,950 - - 136,094,604 - 17,345,564 - 763,007

808,611 1,926,570 32,748,881 32,748,881

- - - - - - - - - - Re-pricing year 1 - 5 years - - - 611,845 7,107,248 3,041,105 86,674 3,487,899 10,967,049 - 11,424,561 503,572,022 22,656,108 - 31,622,727 - 8,099,475 823,097 9,137,827

412,567,554 188,239,520 126,707,982 40,960,665 18,939,219 - 37,917,493 32,437,346 2,669,436,141 136,163,848 85,513,821 158,994,793 744,259,779 1,124,932,240 7 - 12 months - - 20,804,285 - 8,224,312 196,956 119,767 442,929 11,048,819 36,832,811 2,966,665 68,506,819 115,415,256 72,820,788 - 22,116,867 28,634,329 29,993,308 24,307,671

a summary of the group’s interest rate gap position on financial instruments is as follows:

Credit risk exposures relating to othr credit commitments at gross amount are as follows:

4 - 6 months - - 11,234,566 - 26,256,691 95,730 80,568 349,077 10,260,466 21,382,195 957,406 46,634,948 128,971,685 67,658,924 20,724,258 3,892,918 - 56,109,691 1,341,861

Less than 3 months 261,805,783 20,257,131 5,704,968 8,986 26,525,825 116,269 3,123,914 362,195 8,286,897 126,674,409 1,725,515 37,030,911 232,550,547 118,193,104 - 3,967,666 - 1,277,269 1,040,216

Time Loan Pledged assets Treasury bills Bonds Investment securities Available for sale Treasury bills Bonds Held to Maturity Treasury bills Bonds Other assets Total Transaction related bonds and guarantees Guaranteed facilities Clean line facilities for letters of credit and other commitments Future, swap and forward contracts Total 5.2.1 Group In thousands of Naira 31 December 2017 Non-derivative assets Cash and balances with banks Investment under

Access BAnk Plc 253

Annual Report & Accounts 2017