Page 11 - RFHL ANNUAL REPORT 2024_ONLINE

P. 11

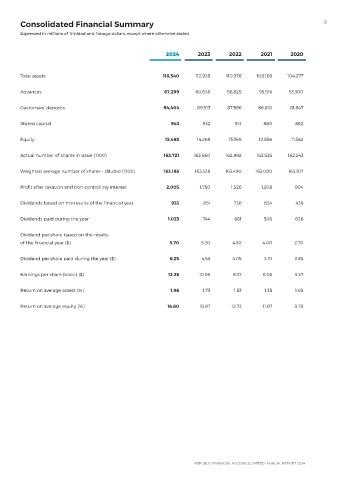

Consolidated Financial Summary 9

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated

2024 2023 2022 2021 2020

Total assets 118,540 112,928 110,978 109,169 104,277

Advances 67,299 60,656 56,829 55,516 53,300

Customers’ deposits 94,404 89,913 87,586 86,610 81,847

Stated capital 943 932 913 880 862

Equity 15,485 14,268 13,369 12,856 11,342

Actual number of shares in issue (‘000) 163,721 163,660 162,992 162,536 162,543

Weighted average number of shares – diluted (‘000) 163,185 163,328 163,490 163,080 163,107

Profit after taxation and non-controlling interest 2,005 1,750 1,526 1,308 904

Dividends based on the results of the financial year 933 851 736 654 439

Dividends paid during the year 1,023 744 661 506 626

Dividend per share based on the results

of the financial year ($) 5.70 5.20 4.50 4.00 2.70

Dividend per share paid during the year ($) 6.25 4.55 4.05 3.10 3.85

Earnings per share (basic) ($) 12.25 10.69 9.37 8.05 5.57

Return on average assets (%) 1.96 1.73 1.53 1.35 1.05

Return on average equity (%) 14.80 13.87 12.73 11.87 8.78