Page 117 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 117

• 115

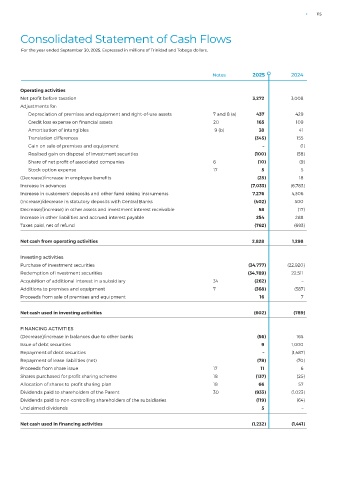

Consolidated Statement of Cash Flows

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars.

Notes 2025 2024

Operating activities

Net profit before taxation 3,272 3,008

Adjustments for:

Depreciation of premises and equipment and right-of-use assets 7 and 8 (a) 437 429

Credit loss expense on financial assets 20 165 109

Amortisation of intangibles 9 (b) 38 41

Translation differences (345) 155

Gain on sale of premises and equipment – (1)

Realised gain on disposal of investment securities (100) (58)

Share of net profit of associated companies 6 (10) (9)

Stock option expense 17 5 5

(Decrease)/increase in employee benefits (25) 18

Increase in advances (7,033) (6,783)

Increase in customers’ deposits and other fund raising instruments 7,276 4,306

(Increase)/decrease in statutory deposits with Central Banks (402) 500

Decrease/(increase) in other assets and investment interest receivable 58 (17)

Increase in other liabilities and accrued interest payable 254 288

Taxes paid, net of refund (762) (693)

Net cash from operating activities 2,828 1,298

Investing activities

Purchase of investment securities (34,777) (22,920)

Redemption of investment securities (34,789) 22,511

Acquisition of additional interest in a subsidiary 34 (262) –

Additions to premises and equipment 7 (368) (387)

Proceeds from sale of premises and equipment 16 7

Net cash used in investing activities (602) (789)

FINANCING ACTIVITIES

(Decrease)/increase in balances due to other banks (56) 165

Issue of debt securities 9 1,000

Repayment of debt securities – (1,487)

Repayment of lease liabilities (net) (78) (70)

Proceeds from share issue 17 11 6

Shares purchased for profit sharing scheme 18 (137) (25)

Allocation of shares to profit sharing plan 18 66 57

Dividends paid to shareholders of the Parent 30 (933) (1,023)

Dividends paid to non-controlling shareholders of the subsidiaries (119) (64)

Unclaimed dividends 5 –

Net cash used in financing activities (1,232) (1,441)