Page 151 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 151

• 149

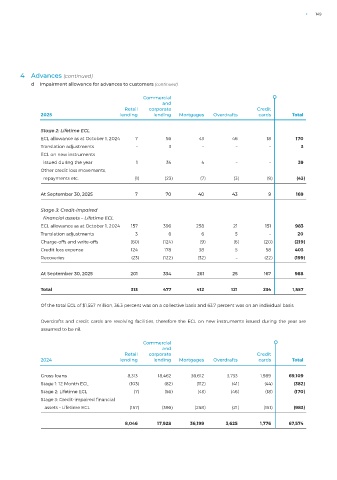

4 Advances (continued)

d Impairment allowance for advances to customers (continued)

Commercial

and

Retail corporate Credit

2025 lending lending Mortgages Overdrafts cards Total

Stage 2: Lifetime ECL

ECL allowance as at October 1, 2024 7 56 43 46 18 170

Translation adjustments – 3 – – – 3

ECL on new instruments

issued during the year 1 34 4 – – 39

Other credit loss movements,

repayments etc. (1) (23) (7) (3) (9) (43)

At September 30, 2025 7 70 40 43 9 169

Stage 3: Credit-impaired

financial assets – Lifetime ECL

ECL allowance as at October 1, 2024 157 396 258 21 151 983

Translation adjustments 3 6 6 5 – 20

Charge-offs and write-offs (60) (124) (9) (6) (20) (219)

Credit loss expense 124 178 38 5 58 403

Recoveries (23) (122) (32) – (22) (199)

At September 30, 2025 201 334 261 25 167 988

Total 313 477 412 121 234 1,557

Of the total ECL of $1,557 million, 36.3 percent was on a collective basis and 63.7 percent was on an individual basis.

Overdrafts and credit cards are revolving facilities, therefore the ECL on new instruments issued during the year are

assumed to be nil.

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Gross loans 8,313 18,462 36,612 3,733 1,989 69,109

Stage 1: 12 Month ECL (103) (82) (112) (41) (44) (382)

Stage 2: Lifetime ECL (7) (56) (43) (46) (18) (170)

Stage 3: Credit-impaired financial

assets – Lifetime ECL (157) (396) (258) (21) (151) (983)

8,046 17,928 36,199 3,625 1,776 67,574