Page 5 - PROHLT010039075_04 _Policy document

P. 5

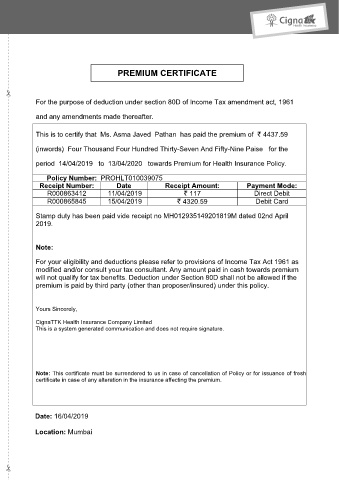

PREMIUM CERTIFICATE

For the purpose of deduction under section 80D of Income Tax amendment act, 1961

and any amendments made thereafter.

This is to certify that Ms. Asma Javed Pathan has paid the premium of ` 4437.59

(inwords) Four Thousand Four Hundred Thirty-Seven And Fifty-Nine Paise for the

period 14/04/2019 to 13/04/2020 towards Premium for Health Insurance Policy.

Policy Number: PROHLT010039075

Receipt Number: Date Receipt Amount: Payment Mode:

R000863412 11/04/2019 ` 117 Direct Debit

R000865845 15/04/2019 ` 4320.59 Debit Card

Stamp duty has been paid vide receipt no MH012935149201819M dated 02nd April

2019.

Note:

For your eligibility and deductions please refer to provisions of Income Tax Act 1961 as

modified and/or consult your tax consultant. Any amount paid in cash towards premium

will not qualify for tax benefits. Deduction under Section 80D shall not be allowed if the

premium is paid by third party (other than proposer/insured) under this policy.

Yours Sincerely,

CignaTTK Health Insurance Company Limited

This is a system generated communication and does not require signature.

Note: This certificate must be surrendered to us in case of cancellation of Policy or for issuance of fresh

certificate in case of any alteration in the insurance affecting the premium.

Date: 16/04/2019

Location: Mumbai