Page 26 - How To Buy A Home with Cat Stevens RVG

P. 26

Call or text Cat Stevens with questions 502-888-3991 www.RiverValleyGroup.com

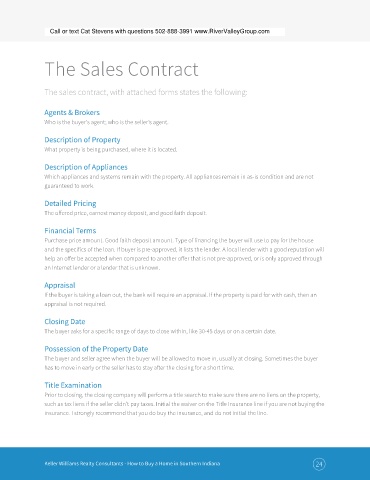

The Sales Contract

The sales contract, with attached forms states the following:

Agents & Brokers

Who is the buyer’s agent; who is the seller’s agent.

Description of Property

What property is being purchased, where it is located.

Description of Appliances

Which appliances and systems remain with the property. All appliances remain in as-is condition and are not

guaranteed to work.

Detailed Pricing

The offered price, earnest money deposit, and good faith deposit.

Financial Terms

Purchase price amount. Good faith deposit amount. Type of financing the buyer will use to pay for the house

and the specifics of the loan. If buyer is pre-approved, it lists the lender. A local lender with a good reputation will

help an offer be accepted when compared to another offer that is not pre-approved, or is only approved through

an Internet lender or a lender that is unknown.

Appraisal

If the buyer is taking a loan out, the bank will require an appraisal. If the property is paid for with cash, then an

appraisal is not required.

Closing Date

The buyer asks for a specific range of days to close within, like 30-45 days or on a certain date.

Possession of the Property Date

The buyer and seller agree when the buyer will be allowed to move in, usually at closing. Sometimes the buyer

has to move in early or the seller has to stay after the closing for a short time.

Title Examination

Prior to closing, the closing company will perform a title search to make sure there are no liens on the property,

such as tax liens if the seller didn’t pay taxes. Initial the waiver on the Title Insurance line if you are not buying the

insurance. I strongly recommend that you do buy the insurance, and do not initial the line.

Keller Williams Realty Consultants - How to Buy a Home in Southern Indiana 24