Page 15 - JDNetworks Brochure_2019

P. 15

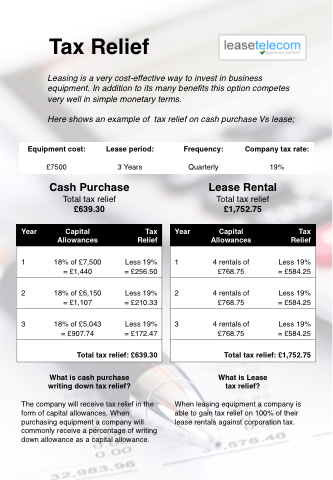

Tax Relief

Leasing is a very cost-effective way to invest in business equipment. In addition to its many benefits this option competes very well in simple monetary terms.

Here shows an example of tax relief on cash purchase Vs lease;

Equipment cost:

£7500

Cash Purchase

Total tax relief

£639.30

Frequency: Company tax rate:

Quarterly 19%

Lease Rental

Total tax relief

£1,752.75

Lease period:

3 Years

Year Capital Tax Allowances Relief

1 18% of £7,500 Less 19% = £1,440 = £256.50

2 18% of £6,150 Less 19% = £1,107 = £210.33

3 18% of £5,043 Less 19% = £907.74 = £172.47

Total tax relief: £639.30

Year Capital Tax Allowances Relief

1 4 rentals of Less 19% £768.75 = £584.25

2 4 rentals of Less 19% £768.75 = £584.25

3 4 rentals of Less 19% £768.75 = £584.25

Total tax relief: £1,752.75

What is cash purchase writing down tax relief?

The company will receive tax relief in the form of capital allowances. When purchasing equipment a company will commonly receive a percentage of writing down allowance as a capital allowance.

What is Lease tax relief?

When leasing equipment a company is able to gain tax relief on 100% of their lease rentals against corporation tax.