Page 8 - Board meeting-MARSH

P. 8

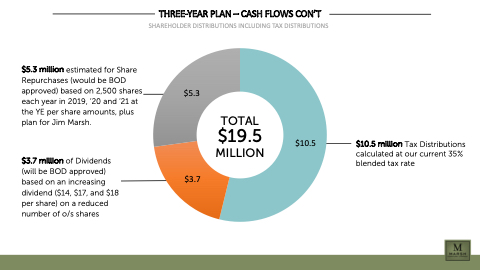

THREE-YEAR PLAN – CASH FLOWS CON’T

SHAREHOLDER DISTRIBUTIONS INCLUDING TAX DISTRIBUTIONS

$5.3 million estimated for Share Repurchases (would be BOD approved) based on 2,500 shares each year in 2019, ‘20 and ‘21 at the YE per share amounts, plus plan for Jim Marsh.

$3.7 million of Dividends (will be BOD approved) based on an increasing dividend ($14, $17, and $18 per share) on a reduced number of o/s shares

$5.3

TOTAL

$19.5 LLION

$10.5

$10.5 million Tax Distributions calculated at our current 35% blended tax rate

MI

$3.7