Page 18 - Cindy_Herzner_Relo

P. 18

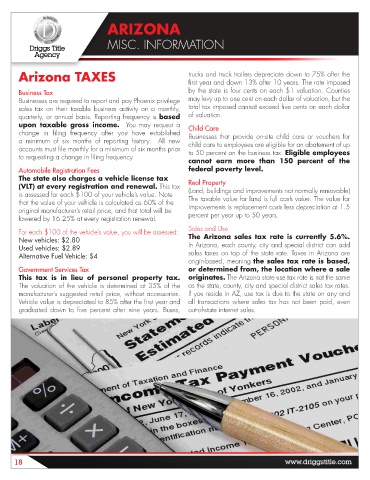

ARIZONA

Relocation Guide

MISC. INFORMATION

Arizona TAXES trucks and truck trailers depreciate down to 75% after the

first year and down 13% after 10 years. The rate imposed

Business Tax by the state is four cents on each $1 valuation. Counties

Businesses are required to report and pay Phoenix privilege may levy up to one cent on each dollar of valuation, but the

sales tax on their taxable business activity on a monthly, total tax imposed cannot exceed five cents on each dollar

quarterly, or annual basis. Reporting frequency is based of valuation.

upon taxable gross income. You may request a Child Care

change in filing frequency after you have established Businesses that provide on-site child care or vouchers for

a minimum of six months of reporting history. All new child care to employees are eligible for an abatement of up

accounts must file monthly for a minimum of six months prior to 50 percent on the business tax. Eligible employees

to requesting a change in filing frequency

cannot earn more than 150 percent of the

Automobile Registration Fees federal poverty level.

The state also charges a vehicle license tax Real Property

(VLT) at every registration and renewal. This tax (Land, buildings and improvements not normally removable)

is assessed for each $100 of your vehicle’s value. Note

that the value of your vehicle is calculated as 60% of the The taxable value for land is full cash value. The value for

original manufacturer’s retail price, and that total will be improvements is replacement costs less depreciation at 1.5

lowered by 16.25% at every registration renewal. percent per year up to 50 years.

Sales and Use

For each $100 of the vehicle’s value, you will be assessed:

New vehicles: $2.80 The Arizona sales tax rate is currently 5.6%.

Used vehicles: $2.89 In Arizona, each county, city and special district can add

Alternative Fuel Vehicle: $4 sales taxes on top of the state rate. Taxes in Arizona are

origin-based, meaning the sales tax rate is based,

Government Services Tax or determined from, the location where a sale

This tax is in lieu of personal property tax. originates. The Arizona state use tax rate is not the same

The valuation of the vehicle is determined at 35% of the as the state, county, city and special district sales tax rates.

manufacturer’s suggested retail price, without accessories. If you reside in AZ, use tax is due to the state on any and

Vehicle value is depreciated to 85% after the first year and all transactions where sales tax has not been paid, even

graduated down to five percent after nine years. Buses, out-of-state internet sales.

18