Page 20 - Money - November 2018

P. 20

BEST BANKS

;L] =SY 2IIH

2O18-2O19

ER 3RPMRI 7EZMRKW

%GGSYRX %GGSYRX

;MRRIVW Rising interest rates and fierce competition to

attract new customers have triggered a kind of

price war among online banks. Instead of lower

We zeroed in on interest rates to find the accounts prices, the result is better rates—and ulti-

that offer the most return for your money. mately more money in your savings account.

In the year since MONEY last compared bank ac-

count terms, the interest rates offered by the top

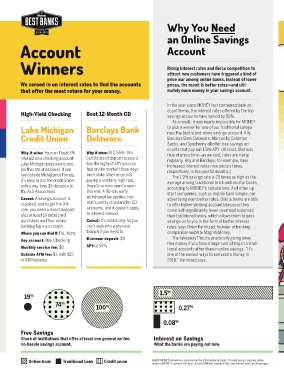

High-Yield Checking Best 12-Month CD savings accounts have spiked by 50%.

As a result, it was nearly impossible for MONEY

0EOI 1MGLMKER &EVGPE]W &ERO to pick a winner for one of our traditional catego-

ries: the best stand-alone savings account. Ally,

'VIHMX 9RMSR (IPE[EVI Barclays Bank Delaware, Marcus by Goldman

Sachs, and Synchrony all offer free savings ac-

counts that pay out 1.9% APY. (At least, that was

Why it wins: You can’t beat 3% Why it wins: At 2.55%, this true at press time—as we said, rates are rising

interest on a checking account: certificate of deposit account regularly. Ally and Barclays, for example, have

Lake Michigan pays nearly dou- has the highest APY you can increased interest rates nine and six times,

ble the rate of its peers. If you find on the market these days. respectively, in the past 12 months.)

live outside Michigan or Florida, And unlike other accounts The 1.9% savings rate is 23 times as high as the

it’s easy to join the credit union paying a similarly high rate, average among traditional brick-and-mortar banks,

with a one-time $5 donation to there’s no minimum to open according to MONEY’s calculations. And other up-

the ALS Association. this one. A 90-day early start companies, such as mobile bank Simple, are

Caveat: A savings account is withdrawal fee applies, but advertising even better rates. Online banks are able

required, and to get the 3% that’s pretty standard for CD to offer higher-yielding accounts because they

rate, you need a direct deposit, accounts, and it doesn’t apply come with significantly fewer overhead expenses

plus at least 10 debit card to interest earned. than traditional banks, which allows them to pass

purchases and four online Caveat: It’s online only so you savings on to you in the form of better interest

banking log-ins a month. can’t walk into a physical rates, says Brian Karimzad, founder of banking

Where you can find it: Fla., Mich. branch if you need to. comparison website MagnifyMoney.

The takeaway? You’re practically giving away

Key account: Max Checking Minimum deposit: $0 free money if you have a large sum sitting in a tradi-

Monthly service fee: $0 APY: 2.55% tional account rather than in online savings. “It’s

Outside ATM fee: $1, with $15 one of the easiest ways to earn extra money in

in ATM rebates 2018,” Karimzad says.

1.5 %

19 %

74 %

100 % 0.27 %

0.08 %

Free Savings

Share of institutions that offer at least one general no-fee, Interest on Savings

no-hassle savings account. What the banks are paying out now.

Online bank Traditional bank Credit union NOTES: MONEY calculations are based on the 150 traditional banks, 23 credit unions, and nine online

banks in MONEY’s universe this year. Outside ATM fees, overdraft fees, and interest rates are all averages.