Page 68 - Money - November 2018

P. 68

0MZI

%0%%77/%

8LI 7EPEV] =SY 1328%2%

2IIH XS &Y]

E ,SQIŜMR

)ZIV] 7XEXI

;%7,-2+832

The dream of homeownership isn’t

necessarily out of reach. BY IAN SALLISBURY 36)+32

-(%,3

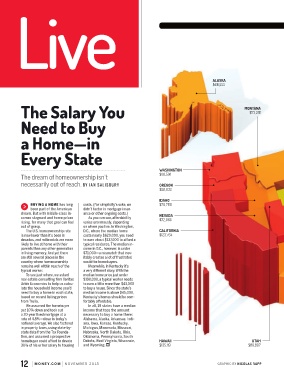

BUYING A HOME has long costs. (For simplicity’s sake, we

been part of the American didn’t factor in mortgage insur-

dream. But with middle-class in- ance or other ongoing costs.) 2):%(%

comes stagnant and home prices As you can see, affordability

rising, for many that goal can feel varies enormously, depending

out of grasp. on where you live. In Washington,

The U.S. homeownership rate D.C., where the median home '%0-*362-%

is now lower than it’s been in costs nearly $620,000, you need

decades, and millennials are more to earn about $137,000 to afford a

likely to live at home with their typical residence.The median in-

parents than any other generation come in D.C., however, is under

in living memory.And yet there $71,000—a mismatch that inev-

are still several places in the itably creates a lot of frustrated

country where homeownership would-be homebuyers.

remains well within reach of the Meanwhile, in Kentucky it’s

typical worker. a very different story.With the

To see just where, we asked median home price just under

real estate consulting firm Veritas $190,000, a typical worker needs

Urbis Economics to help us calcu- to earn a little more than $43,000

late the household income you’d to buy a house. Since the state’s

need to buy a home in each state, median income is above $45,000,

based on recent listing prices Kentucky’s homes should be com-

from Trulia. fortably affordable.

We assumed the homebuyer In all, 19 states have a median

put 10% down and took out income that tops the amount

a 30-year fixed mortgage at a necessary to buy a home there:

rate of 4.8%—close to today’s Alabama, Alaska, Arkansas, Indi-

national average.We also factored ana, Iowa, Kansas, Kentucky,

in property taxes, using state-by- Michigan, Minnesota, Missouri,

state data from the Tax Founda- Nebraska, North Dakota, Ohio,

tion, and assumed a prospective Oklahoma, Pennsylvania, South

homebuyer could afford to devote Dakota, West Virginia, Wisconsin, ,%;%-- 98%,

30% of his or her salary to housing and Wyoming.

MONE Y. C O M NO VEMBER 2 0 1 8 GRAPHIC BY NICOLAS RAPP