Page 74 - Money - November 2018

P. 74

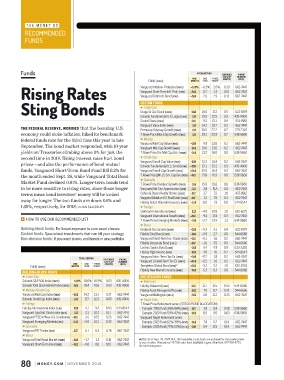

THE MONEY 50

6)'311)2()(

*92(7

*YRHW TOTAL RETURN

EXPENSES

PHONE

(AS % OF NUMBER

O ONENE ONE THREE ASSETS) (800)

FUND(TICKER) MONTH YEAR YEARS 1

MONTH

6MWMRK 6EXIW Vanguard Inflation-Protected (VIPSX) –0.3 0.7 2.9 0.20 662-7447

–1.3% –0.3% 2.0%

0.15

1.3

662-7447

Vanguard Short-Term Infl.-Prot.(VTIPX)

662-7447

0.13

VanguardTotal Intl. Bond (VTIBX)

2.0

–0.3

7XMRK &SRHW CU Large-Cap 0.8 15.0 17.2 0.5 621-3979

CUSSTOMTOM FU FUNDSNDS

Dodge & Cox Stock (DODGX)

Schwab Fundamental U.S. Large(SFLNX) 1.0 15.8 15.5 0.3 435-4000

Sound Shore (SSHFX) 0.1 9.2 13.1 0.9 551-1980

Vanguard ValueIndex(VIVAX) 1.0 14.2 15.7 0.2 662-7447

THE FEDERAL RESERVE, WORRIED that the booming U.S.

Primecap Odyssey Growth (POGRX) 1.2 30.5 22.2 0.7 729-2307

economy could stoke inflation, hiked its benchmark T. Rowe Price Blue Chip Growth(TRBCX) 1.5 29.1 20.9 0.7 638-5660

federal funds rate for the third time this year in late Midcap

Vanguard Mid-Cap Value (VMVIX) –0.8 9.9 12.6 0.2 662-7447

September. The bond market responded, with 10-year

Vanguard Mid-Cap Growth(VMGIX) 0.4 19.0 13.6 0.2 662-7447

yields on Treasuries climbing above 3% for just the T. Rowe Price Div. Mid Cap Gro.(PRDMX) 0.4 21.2 16.0 0.8 638-5660

second time in 2018. Rising interest rates hurt bond Small-Cap

Vanguard Small-Cap Value (VISVX) –2.0 12.3 14.4 0.2 662-7447

prices—and also the performance of bond mutual

Schwab Fundamental U.S. Small(SFSNX) –2.0 15.1 15.2 0.3 435-4000

funds. Vanguard Short-Term Bond Fund fell 0.2% for Vanguard Small-Cap Growth (VISGX) –0.4 25.0 16.4 0.2 662-7447

the month ended Sept. 26, while Vanguard Total Bond T. Rowe Price QM U.S. Sm.-Cap Gro.(PRDSX) –0.1 23.8 16.9 0.8 638-5660

Specialty

Market Fund declined 0.81%. Longer-term bonds tend

T. Rowe Price Dividend Growth (PRDGX) 1.5 15.8 15.6 0.6 638-5660

to be more sensitive to rising rates, since those longer Vanguard Intl. Div.Appreciation (VIAIX) –1.1 3.8 N.A. 0.4 662-7447

terms mean bond investors’ money will be locked Cohen & Steers Realty Shares (CSRSX) –3.7 3.7 7.2 1.0 437-9912

Vanguard Global ex-U.S. Real Estate(VGXRX) –0.7 1.2 7.9 0.3 662-7447

away for longer. The two funds are down 0.6% and

Fidelity Select Natural Resources(FNARX) –1.4 11.0 7.9 0.8 544-8544

1.69%, respectively, for 2018.—IAN SALISBURY Foreign

Oakmark International (OAKIX) 2.2 –4.0 10.8 1.0 625-6275

Vanguard International Growth(VWIGX) –0.1 9.4 17.4 0.5 662-7447

,3; 83 97) 396 6)'311)2()( 0-78 T. Rowe Price Emerging Markets (PRMSX) –1.8 –2.7 13.9 1.2 638-5660

Bond

Building-block funds: For broad exposure to core asset classes Dodge & Cox Income (DODIX) –0.3 –0.3 3.1 0.4 621-3979

Custom funds: Specialized investments that can tilt your strategy Fidelity TotalBond(FTBFX) –0.6 –0.9 2.7 0.5 544-6666

One-decision funds: If you want stocks and bonds in one portfolio Vanguard Short-Term Inv.-Grade (VFSTX) –0.1 –0.1 1.6 0.2 662-7447

Fidelity Corporate Bond(FCBFX) –0.7 –1.0 3.5 0.5 544-6666

Loomis Sayles Bond (LSBRX) 0.3 0.4 4.9 0.9 633-3330

Fidelity High Income(SPHIX) 0.5 4.0 7.6 0.7 544-8544

VanguardIntm.-Term Tax-Ex.(VWITX) –0.8 –0.7 1.8 0.2 662-7447

TOTAL RETURN EXPENSES PHONE

(AS % OF NUMBER VanguardLimited-Term Tax-Ex.(VMLTX) –0.4 –0.2 1.0 0.2 662-7447

O

ONENE ONE THREE ASSETS) (800) 2

MONTH

FUND(TICKER) MONTH YEAR YEARS 1 Templeton Global Bond(TPINX) –0.3 –3.2 3.2 1.0 632-2301

Fidelity New Markets Income(FNMIX) 0.3 –5.3 6.3 0.8 544-6666

BUILDING-BLOCK FUNDS

Large-Cap ONE-DE-DECISCISIONION FU FUNDSNDS

ONE

Schwab S&P 500 Index (SWPPX) 1.3% 18.6% 16.9%1.3% 0.03 435-4000 Balanced

SchwabTotal Stock Market Index(SWTSX) 0.80.8 18.4 16.6 0.03 435-4000 Fidelity Balanced (FBALX) 0.1 11.7 11.5 0.55 544-6666

Midcap/Small-Cap FidelityAsset Manager 60%(FSANX) 0.2 7.8 9.7 0.73 544-6666

Vanguard Mid-Cap Index (VIMSX) –0.2–0.2 14.2 13.1 0.17 662-7447 Vanguard Wellington (VWELX) 0.5 8.8 11.2 0.25 662-7447

Schwab Small Cap Index(SWSSX) –1.81.8 17.7 16.3 0.05 435-4000 Target Date

–

Foreign T. T. RowRowe Pe Pricrice Re Retietiremrementent se serieries (s (STOSTOCK/CK/BONBONDALDALLOCLOCATIATIONON N)

Fidelity International Index (FSIIX) 2.33 4.7 9.4 0.05 544-8544 Example: 2005 Fund (36%/64%)(TRRFX) 0.1 3.8 6.8 0.58 638-5660

2.

VanguardTotal Intl. Stock Index(VGTSX) 1.22 3.1 10.2 0.17 662-7447 Example: 2020 Fund (58%/42%)(TRRBX) 0.2 6.5 9.5 0.63 638-5660

1.

Vanguard FTSEA/W ex-U.S. Small(VFSVX) –0.1–0.1 2.6 10.5 0.25 662-7447 VanguardTarget Retirement series

Vanguard Emerging Markets(VEIEX) –1.2.2 –3.0 10.2 0.32 662-7447 Example: 2025 Fund (62%/38%)(VTTVX) 0.4 7.4 9.7 0.14 662-7447

–1

Specialty Example: 2035 Fund (77%/23%)(VTTHX) 0.6 9.4 11.5 0.14 662-7447

Vanguard REIT Index (VGSIX) –3.7–3.7 –0.1 6.3 0.26 662-7447

Bond

VanguardTotal Bond Market (VBMFX) –0.8–0.8 –1.7 1.3 0.15 662-7447 NOTES: As of Sept. 26, 2018. N.A.: Not available. Load funds are included for those who prefer

to use a broker. 1 Annualized. 2 4.25% sales load. SOURCES: Lipper, New York, 877-955-4773;

Vanguard Short-Term Bond(VBISX) –0.20.2 –0.6 0.6 0.15 662-7447

–

the fund companies

MONE Y. C O M NO VEMBER 2 018