Page 236 - Manual Of SOP

P. 236

Verification

(e) The prices of raw materials to be seen and compared amongst

different constituents of DI and producer/exporters to the extent

possible or feasible. This is desirable especially if the DI is also using

the imported raw material.

(f) The basis of pricing of captive inputs consumption should also be

seen and the costs compared with market price, if available.

(g) The form of packing used by producer/exporter for exports to India

is very relevant, particularly when it is observed that packing for

domestic sale and export sale is different. It is,therefore, necessary

that the costing of producer/exporter/DI is worked out for the

relevant packing to ensure a fair comparison.

(h) The team should take verification exhibits which support their

findings. The exhibits may include the following source documents:

• Sample calculations;

• Allocation worksheets;

• Invoices to the respondent;

• Expense ledger entries;

• Journal entry slips;

• Records of payments;

• Accounts receivable and payable ledgers;

• General ledger entries; and

• Other ledgers and records, which may be used to support

such items as calculation of credit days, interest rates,

inventory carrying time, duty drawbacks.

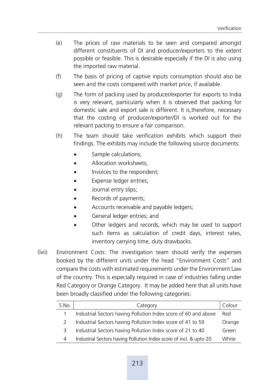

(lvii) Environment Costs: The investigation team should verify the expenses

booked by the different units under the head “Environment Costs” and

compare the costs with estimated requirements under the Environment Law

of the country. This is especially required in case of industries falling under

Red Category or Orange Category. It may be added here that all units have

been broadly classified under the following categories:

S.No. Category Colour

1 Industrial Sectors having Pollution Index score of 60 and above Red

2 Industrial Sectors having Pollution Index score of 41 to 59 Orange

3 Industrial Sectors having Pollution Index score of 21 to 40 Green

4 Industrial Sectors having Pollution Index score of incl. & upto 20 White

213