Page 30 - Walter Robbs 2018 Benefit Guide

P. 30

Glossary of Health Coverage and Medical Terms

This glossary defines many commonly used terms, but isn’t a full list. These glossary terms and definitions are

intended to be educational and may be different from the terms and definitions in your plan or health

insurance policy. Some of these terms also might not have exactly the same meaning when used in your

policy or plan, and in any case, the policy or plan governs. (See your Summary of Benefits and Coverage for

information on how to get a copy of your policy or plan document.)

Underlined text indicates a term defined in this Glossary.

See page 6 for an example showing how deductibles, coinsurance and out-of-pocket limits work together in a

real life situation.

Allowed Amount This is the maximum payment the plan will pay for a covered health care service. May also be

called “eligible expense,” “payment allowance,” or “negotiated rate.”

Appeal A request that your health insurer or plan review a decision that denies a benefit or payment (either in

whole or in part).

Balance Billing When a provider bills you for the balance remaining on the bill that your plan doesn’t cover. This

amount is the difference between the actual billed amount and the allowed amount. For example, if the provider’s

charge is $200 and the allowed amount is $110, the provider may bill you for the remaining $90. This happens

most often when you see an out-of-network provider (non-preferred provider). A network provider (preferred

provider) may not bill you for covered services.

Claim A request for a benefit (including reimbursement of a health care expense) made by you or your health care

provider to your health insurer or plan for items or services you think are covered.

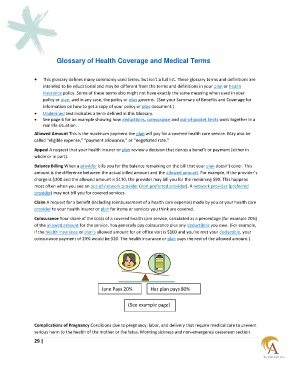

Coinsurance Your share of the costs of a covered health care service, calculated as a percentage (for example 20%)

of the allowed amount for the service. You generally pay coinsurance plus any deductibles you owe. (For example,

if the health insurance or plan’s allowed amount for an office visit is $100 and you’ve met your deductible, your

coinsurance payment of 20% would be $20. The health insurance or plan pays the rest of the allowed amount.)

Jane Pays 20% Her plan pays 80%

(See example page)

Complications of Pregnancy Conditions due to pregnancy, labor, and delivery that require medical care to prevent

serious harm to the health of the mother or the fetus. Morning sickness and non-emergency caesarean section

29 |